ETF Tracker StatSheet

You can view the latest version here.

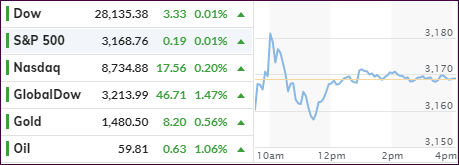

SEE-SAWING BUT EKING OUT SOME TINY GAINS

- Moving the markets

An early spike hit a brick wall with the S&P 500 backing off its highs and fading below the unchanged line. That came as no surprise, as the US-China trade deal saga affected market direction due to a variety of headlines spreading some confusion.

We learned that the warring parties had reached an agreement on text on a phase 1 deal and will now move towards signing as quickly as possible. Trump tweeted these details:

- “We have agreed to a very large Phase One Deal with China.

- They have agreed to many structural changes and massive purchases of Agricultural Product, Energy, and Manufactured Goods, plus much more.

- The 25% Tariffs will remain as is, with 7 1/2% put on much of the remainder.

- The Penalty Tariffs set for December 15th will not be charged because of the fact that we made the deal.

- We will begin negotiations on the Phase Two Deal immediately, rather than waiting until after the 2020 Election. This is an amazing deal for all. Thank you!”

The fly in the ointment is what the US will get in exchange. One analyst pointed out that this remains unclear—China has promised to buy “more” agri products, but without providing actual details, while saying it plans to import US wheat, rice, and corn within quotas.

The market took it as a mixed bag and, in the absence of more substance, simply sold off. After all, this constant “crying wolf” will get ignored eventually—and by mid-day it did.

However, dip buyers stepped in and a slow recovery brought the indexes back to their respective unchanged lines where they vacillated into the close.

Not much was gained today, but for the week the S&P 500 added +0.7%. In bond land, Thursday’s crazy spike in yields, reversed and erased almost all losses sustained yesterday.

In

the end, it was all about the Fed and the alleged trade deal with China.

Economic data points did not weigh on equities, despite Bloomberg’s US

Macro Surprise Index dropping to a level last seen 3 months ago.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

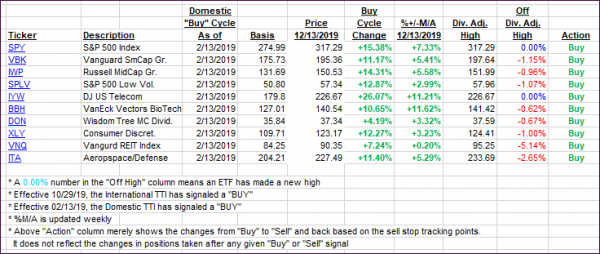

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic one slipping, while the International one jumped sharply.

Here’s how we closed 12/12/2019:

Domestic TTI: +6.40% above its M/A (prior close +5.87%)—Buy signal effective 02/13/2019

International TTI: +5.41% above its M/A (prior close +4.18%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli