- Moving the markets

Not just US futures, but global markets as well, hit the skids early on, a sight which we have not seen in some 5 weeks, as the markets have been on a tear ever since dumping during the first 2 days of October.

The two catalysts for the early thrashing was simply lack of optimism on the trade front with Trump saying that discussions with China were going “very nicely” but cautioned that recent reports about an agreement to roll back tariffs weren’t accurate. He added that “the level of tariff lift is incorrect” without further elaborating.

Adding to this uncertainty was a sudden explosion in violence during the 24th straight week of protests in Hong Kong with one protester seriously injured while another one was set on fire.

That was enough to send the markets reeling, but a pullback of some sort was way overdue, and today’s events simply provided a reason, which was also helped by the fact that the bond markets were closed for the holiday.

Then a White Knight appeared in the form of the much beaten up Boeing Corporation, which announced that its maligned and grounded fleet of 737 MAX could “see return to service early next year.”

That was exactly the impetus the computer algos needed, the bottom was established, and up we went. The Dow was the main beneficiary by going green, with the other two major indexes heading towards their unchanged lines but falling short of closing above it.

The major market trend remains up, but I would not be surprised to see some weakness over the next few trading days, unless of course, a new lipstick is applied to that trade pig.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

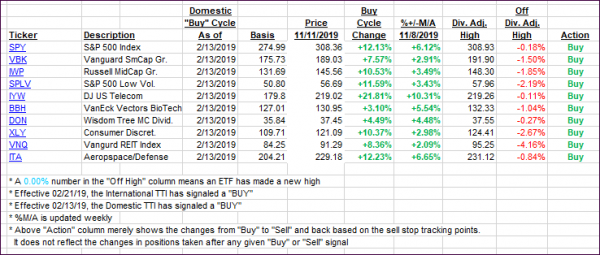

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slid with no impact on major market direction.

Here’s how we closed 11/11/2019:

Domestic TTI: +5.37% above its M/A (prior close +5.65%)—Buy signal effective 02/13/2019

International TTI: +4.10% above its M/A (prior close +4.33%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli