ETF Tracker StatSheet

You can view the latest version here.

STUMBLING INTO THE WEEKEND

1. Moving the markets

All week long, the markets lacked some serious upward momentum with any rally attempts being rebuffed and cut short. As a result, the major indexes vacillated around their unchanged lines and failed to make much headway but managed to close slightly higher for the week.

Disappointing Chinese economic data weighed on sentiment, as it appeared that signs of further cooling of business activity took their toll. The tech sector lagged, as Broadcom lowered its outlook for the rest of the year, which dashed hopes for a rebound in Semiconductors.

Tensions in the mid-East increased with the blame game, as to who was responsible for the attack on 2 oil tankers, continuing. The U.S. blamed Iran, while Teheran denied any responsibility.

On the domestic front, good news was bad news again, as the lame duck of the year, namely retails sales, rose +0.5% in May, just a little below expectations of +0.7%.

However, April sales were revised to a +0.3% increase from a previously reported -0.2% decline. That did not sit well with the markets. Why? Traders were disappointed, as stronger economic data could potentially sway the Fed from lowering rates. Go figure…

Another reason for the lackluster market environment is two important events scheduled for next week. First, the two-day Fed meeting with the release of their interest rate policy set for Wednesday. Second, the G-20 meeting during which Trump and Chinese Premier Xi may meet ‘to solve or not to solve’ the ever-escalating trade war.

Depending on the various outcomes, markets could be rallying sharply or, if disappointed by, say, a too hawkish Fed, sell off and pull bond yields much lower. However, wherever yields may end up, it will far better than in Europe where the German 10-year yield hit a new negative record of -0.27%. Ouch!

No one knows how things will play out, but it promises to be a highly volatile week.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

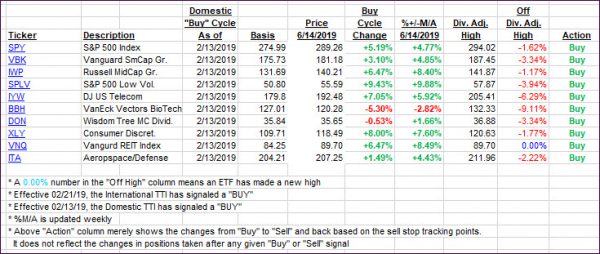

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped with the International one giving back more, which is why I am cautious and want to see more staying power, before pulling the trigger and issuing a new ‘Buy.’ As mentioned above, next week’s activity can very well give us a better clue as to the next directional move in the markets.

Here’s how we closed 06/14/2019:

Domestic TTI: +4.56% above its M/A (last close +4.84%)—Buy signal effective 02/13/2019

International TTI: +1.45% above its M/A (last close +1.79%)—Sell signal effective 05/30/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli