ETF Tracker StatSheet

A Weak Close To A Positive Month

[Chart courtesy of MarketWatch.com]- Moving the markets

The major indexes struggled to find some footing today, but in the end hugged the unchanged line after vacillating above and below it throughout the session.

Geopolitical tensions from Italy were back in focus after the Italian coalition decided yesterday on an “in your face” attitude towards the EU by simply widening their regulated budget deficit, which I mentioned yesterday. The verbal fireworks continued today and will sure be headline news in the following weeks.

In Argentina, the Peso plunged to new record lows, as the government hiked a major interest rate to 65%. Ouch! All this despite promises by the IMF to increase its bailout package. This is just the beginning of further deterioration in the Emerging Markets arena with a domino effect being a likely outcome that eventually will impact the developed nations as well.

Domestically, the major indexes had a mixed September but a strong quarter with the S&P 500 rising some 7%, its biggest quarterly advance sine 2013. This made it easy for investors, who tend to have very short-term memories, to not only forget the sharp market corrections of February and April but also appreciate the fact that US stocks are still outperforming the world’s indexes.

Makes you wonder how long that path can continue, especially given the fact that bonds had a bloodbath in September with yields ending at a much higher level than when they started the month. Rallying equities and rising bond yields are not a combination that will last for long.

Adding to that uncertainty was that true economic data points are decoupled from equity prices as this chart shows. Will the month of October be the big equalizer, as we’ve seen in the past? Who knows, but I am glad that we have an exit strategy in place, just in case reality bites the bulls in the butt.

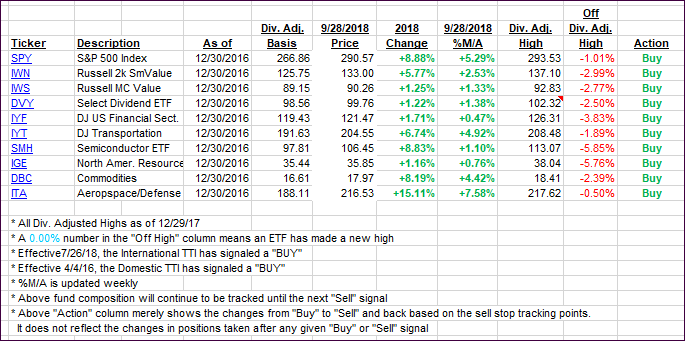

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed again with the Domestic one gaining and the International one pulling back.

Here’s how we closed 09/28/2018:

Domestic TTI: +4.40% above its M/A (last close +3.96%)—Buy signal effective 4/4/2016

International TTI: +1.18% above its M/A (last close +1.57%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli