- Moving the markets

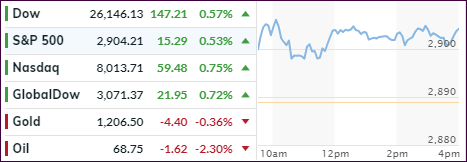

The bulls dominated again and pushed the major indexes higher with the S&P 500 scoring its fourth straight win. Yesterday’s laggard turned into today’s leader, as the tech sector picked up steam with the Nasdaq adding +0.75%, after spiking during the last few minutes of the session.

Helping set the bullish tone were reports suggesting that China was more receptive to the latest propositions from the US regarding trade talk issues. Of course, as we’ve seen in the past, these types of headlines tend to come and go and have, so far, not produced any tangible results.

In Europe, the ECB made no change to interest rates and announced that it has no plans to do so till summer 2019. That seemed to sooth markets despite them trimming the GDP forecast for 2018 and next year as well. Market reaction was muted.

Looking at the big picture, we see that US stocks continue to decouple from the rest of the world. That simply means that the US markets are still considered the least dirty shirt in the dirty laundry basket.

Again, as trend followers, we don’t really care about that. We are only concerned with one thing, which is the major direction of the domestic markets, as calculated by our Domestic TTI (section 3), and that remains “up,” so we’ll stay invested until that fact changes.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

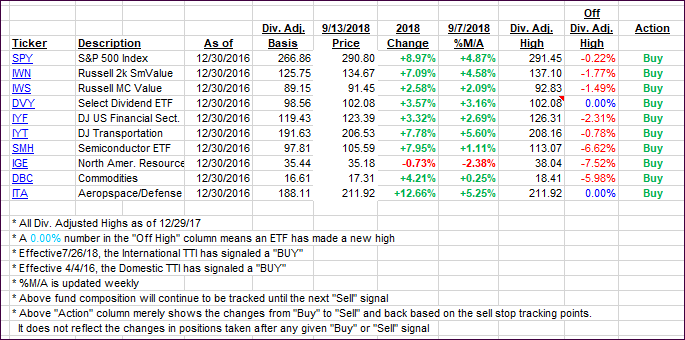

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) continued their march higher as the S&P 500 scored its 4th day of consecutive gains.

Here’s how we closed 09/13/2018:

Domestic TTI: +5.35% above its M/A (last close +4.91%)—Buy signal effective 4/4/2016

International TTI: -0.31% below its M/A (last close -0.99%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli