ETF Tracker StatSheet

LACKLUSTER SESSION KEEPS INDEXES IN CHECK

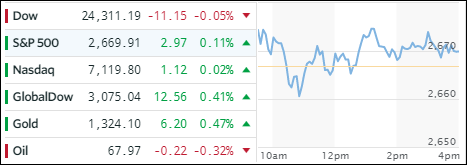

[Chart courtesy of MarketWatch.com]- Moving the markets

A rising tide is supposed to lift all boats, but that was clearly not the case today. After yesterday’s strong earnings results from Amazon, Intel and Microsoft, you would have expected a follow through bullish day for the tech sector, which never happened.

After an early uptick, the markets vacillated around the unchanged line and ended up with the Dow in the red, the Nasdaq just about unchanged and the S&&P gaining a tad. It was dampened enthusiasm at its best despite the 3 players being involved representing some of the biggest and most influential companies in the world. Go figure…

Maybe Exxon’s tepid earnings report contributed to the lack of buying along with the latest GDP data. It showed that sharply slowing personal consumption had an effect as the Q4 2017 GDP number of 2.9% looks really good right now compared to the just released first quarter annualized GDP of 2.3%, which is the lowest in the past year.

None of these numbers confirm that the economy is rip-roaring but is decelerating with only some sectors showing strength. Even an assist in the form of the 10-year bond yield (2.96%) continuing to slide further away from the 3% marker had no influence on market behavior.

I think we are still stuck in a broad sideways pattern but we will, as is virtually a guarantee, break out at some point. The open ended question is whether it will be to the upside or to the downside. Only time will tell.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

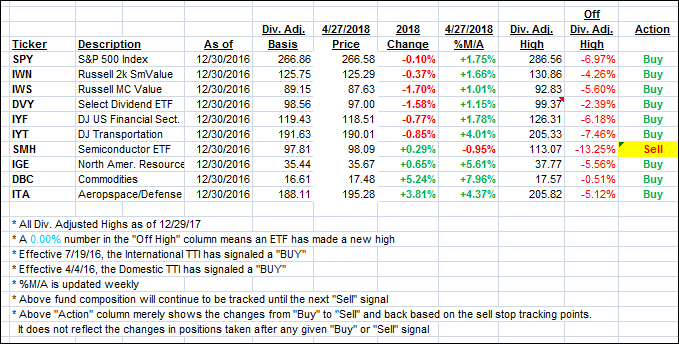

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed as market momentum was mixed.

Here’s how we closed 4/27/2018:

Domestic TTI: +1.02% above its M/A (last close +1.15%)—Buy signal effective 4/4/2016

International TTI: +1.60% below its M/A (last close +1.70%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli