ETF Tracker StatSheet

https://theetfbully.com/2018/01/weekly-statsheet-etf-tracker-newsletter-updated-01-25-2018/

S&P 500 AND DOW SPORT LARGEST WEEKLY DECLINE IN 2 YEARS

[Chart courtesy of MarketWatch.com]- Moving the markets

There was simply no place to hide. After having broken all kinds of records during the past year, it was time for the bears to have their moment in the spotlight—at least for this week. The major indexes got spanked with the S&P 500 dropping -2.12% for the day, its biggest one-day drop since September 2016, and -3.9% for the week. Not helping matters was the VIX, which saw its largest spike since August 2015. However, the correction was orderly with no sense of panic.

Today’s pullback was not limited to US stocks, but equities around the world (China, Europe, Asia) confronted the long-known reality that nothing goes up forever. The question now is whether this is the beginning of a new bearish trend or merely a hiccup in this aging bull market. At this point it’s too early to tell, and we will need more data points to make that decision.

Contributing to this week’s market drop were a variety of reasons with rising interest rates being on top of the list. I have pointed out in previous posts that once a certain threshold is passed, bond yields will have a negative impact on equity prices. The 10-year yield is one of those indicators, and it shot higher again today by 6 basis points to close at 2.84%, its highest level since January 2014. That resulted in another pounding of the 20-year bond (TLT), which lost -0.93%.

Also not assisting the bulls was today’s stronger than expected jobs report (200k added) showing that wages grew at the fastest pace in more than 8 years, causing inflation fears to spread and pushing yields higher. As MarketWatch pointed out correctly, “the market is now pricing in tighter monetary policy if inflation driven by wage growth accelerates.”

Needless to say, red was the color of choice for the day. Interestingly, the US Dollar (UUP) vacillated around the unchanged line but managed to eke out a gain of +0.61%.

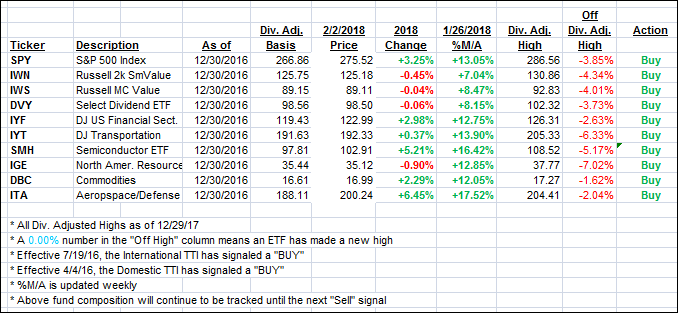

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed sharply south as the first correction in over a year finally materialized. Both of our indexes remain in bullish territory.

Here’s how we closed 2/2/2018:

Domestic TTI: +3.60% above its M/A (last close +4.64%)—Buy signal effective 4/4/2016

International TTI: +6.09% above its M/A (last close +8.30%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli