ETF Tracker StatSheet

https://theetfbully.com/2018/01/weekly-statsheet-etf-tracker-newsletter-updated-01-04-2018/

EXTENDING THE RALLY

[Chart courtesy of MarketWatch.com]- Moving the markets

Who cares what the news headlines say or that the just released jobs report was downright dismal. This year, anything appears to be bullish for the markets—so far. The major indexes posted record gains again for the 4th straight positive session in part supported by the tax package and a favorable outlook on earnings.

ZH summed up the week as follows:

- Record highs for S&P, Dow, and Nasdaq.

- Lowest VIX close ever.

- First time VIX has ever traded at or below 9.00 for 3 straight days ever.

- Nasdaq’s best start to a year since 2004.

- Near record streak for stocks to remain within 5% of all-time high ever.

- Individual investors’ highest stock exposure since 2000.

- Fastest yield curve flattening since 2007.

- Longest streak of complacency for risk ever.

- Longest winning streak for gold ever.

- Longest winning streak for global commodities ever.

As we’ve seen all week, after the opening bell rang, equities jumped higher and never looked back going up in pretty much a straight line. Our ETF candidates followed suit and rewarded us with another profitable session.

Leading the charge today was a tie with Aerospace & Defense (ITA) and Emerging Markets (SCHE) taking top honors with a gain +0.90% each. They were followed by Semiconductors (SMH +0.65%), Large Caps (SCHX +0.63%) and the Dividend ETF (SCHD +0.62%).

Interest rates rose a tad pushing the 20-year bond lower by -0.29%. Gold stayed about even, and the US Dollar (UUP) halted its losing trend by managing to eke out a tiny gain of +0.08%, which appears to be merely a temporary break on its way down to take out the 2017 lows made in September.

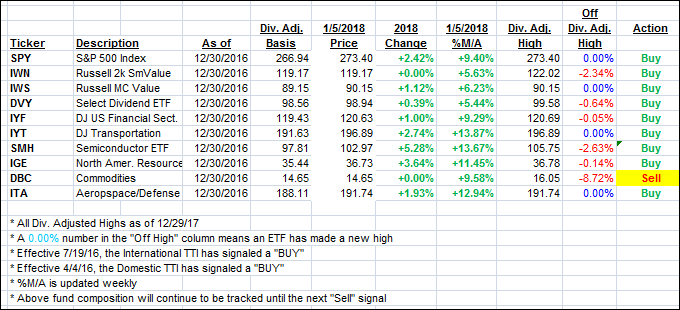

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) followed the bullish theme of the week and closed higher.

Here’s how we closed 1/5/2018:

Domestic TTI: +4.37% above its M/A (last close +4.26%)—Buy signal effective 4/4/2016

International TTI: +6.71% above its M/A (last close +6.60%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli