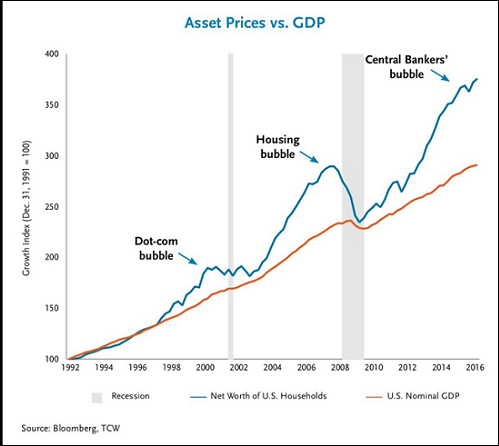

The trouble with inflating asset bubbles is that you have to keep inflating them or they pop. Unfortunately for the bubble-blowing central banks, asset bubbles are a double-bind: you cannot inflate assets forever. At some unpredictable point, the risk and moral hazard that are part and parcel of all asset bubbles trigger an avalanche of selling that pops the bubble.

This is another facet of The Fed’s Double-Bind: if you stop pumping asset bubbles, they pop as participants realize the music has stopped, and if you keep pumping them, they expand to super-nova criticality and implode.

There are several dynamics at play in this double-bind.

1. The process of inflating a bubble (for example, the current bubbles in stocks and real estate) requires pushing investors and speculators alike into risky asset classes. This puts the market at increasing risk as everyone is pushed to one side of the boat.

2. Those on the other side of the boat (i.e. shorts) are slowly but surely eradicated as the pumping keeps inflating the bubble. When the bubble finally bursts, there are no shorts left to cover, i.e. buy stocks at lower prices to reap their profits.

3. As the bubble continues to expand, the money available to enter the market and keep prices rising declines. The very success of the pumping process strips the markets of new sources of new money, leading to a point where normal selling exceeds new-money buying and the bubble collapses.

4. Money pumping by central banks and governments follows a curve of diminishing return. One analogy is insulin insensitivity: as the systemic distortions build, markets become increasingly insensitive to money pumping. Authorities respond to this intrinsic process of increasing insensitivity by pumping even more money into the system.

But as with insulin insensitivity, at some point the system loses all sensitivity to money pumping: no matter how much money central authorities inject, the markets refuse to go higher. At this point, the stick-slip nature of bubbles manifests and modest selling triggers a collapse as participants all rush for the exits. Buyers have vanished and there is no longer a bid at any price.

5. Having pumped the assets higher with ever-greater injections of speculative risk and pumping, central banks and states have exhausted their ability to re-inflate assets as they collapse.

This growing insensitivity to money pumping is visible in the stock market’s response to each new QE program: each market advance is of shorter duration, and each rise is less robust than the last one.

This degradation of response to pumping has forced the Fed to pursue a policy of infinite QE, with no time or pumping limits.

The idea that authorities can massage their pumping to keep asset bubbles inflated at a permanently high plateau is currently being tested. The Fed is implicitly suggesting that it can adjust the expectations/policy dials with such control that it can keep the bubble inflating essentially for years to come.

Systems cannot be controlled once risk and moral hazard have been raised to levels where instability is an intrinsic feature of the system. Those who actually believe the Fed can keep asset bubbles inflated at a permanently high plateau will discover their error in dramatic fashion, as the bigger the bubble, the more violent the implosion.

This is the super-nova nature of asset bubbles: if you try to deflate the bubble slowly, it implodes, but if you keep inflating the bubble it eventually implodes from its internal extremes.

Contact Ulli