- Moving the Markets

At least according to today’s performance, much confidence was given to Trump’s advertised sweeping tax reform, as the Russell 2000 notched not only a record close but also showed its biggest gain since the election. Strangely enough, the Fed’s Bullard came out and jawboned that “equity valuations may be stretched,” making me wonder if that is an admission that the stock market is in a bubble?

In regards to equity ETFs, we saw plenty of green. Leading the charge were Semiconductors (SMH), which surged +2.25% with SmallCaps (SCHA) taking second place with a solid gain of +1.57%. Ending up modestly in the red were Emerging Markets (SCHE) with -0.45%.

When there are winners, there must be losers. Bond yields rose sharply with the 10-year gaining 7 basis points to 2.31%. This is in striking distance of its 200-day M/A (2.33%). Any break above could indicate that the 2 month bond rally (lower rates) has run its course, and we’re back to an environment of higher yields. As a consequence, the 20-year bond price (TLT) gapped lower and lost -1.51%.

The threat of higher yields powered the US Dollar index (UUP) off its early September lows and above its 50-day M/A. On a daily chart, it still looks like a dead cat bounce, but continuously rising rates could certainly breathe new life into the for dead declared dollar—at least for the time being.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

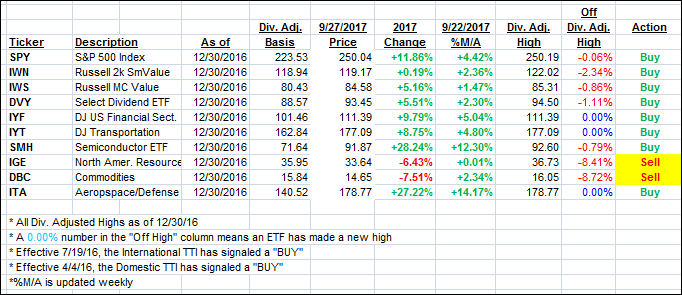

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) jumped higher as a bullish tone for equities prevailed.

Here’s how we closed 9/27/2017:

Domestic TTI: +2.75% (last close +2.42%)—Buy signal effective 4/4/2016

International TTI: +6.45% (last close +6.18%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli