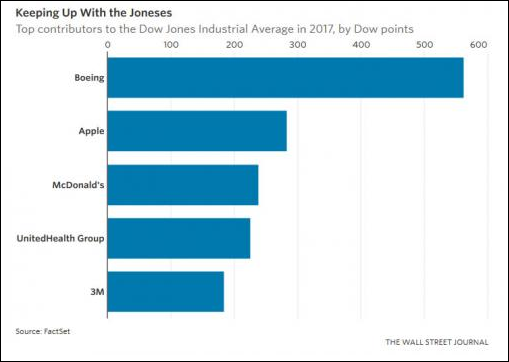

We’ve noted over the last two weeks that the Dow Industrials have been diverging from most other indices and particularly the Dow Transports. An important part of the divergence has been the relative narrowness of the rally in the Dow. In today’s WSJ, Justin Lahart took note of the narrowness:

Americans cheering the U.S. stock market’s latest milestone should pause to thank the rest of the world for making it possible. The Dow Jones Industrial Average breached 22000 Wednesday after rising more than 2000 points so far this year. Boeing counted for 563 points of that gain. About 60% of its sales come from overseas.

No. 2, contributing 283 points, is Apple, which gets two-thirds of its sales abroad.

No. 3 is McDonald’s, contributing 239 points; foreign sales count for about two-thirds of its total.

Indeed, while there are notable exceptions (hello, International Business Machines ), the greater the share of a company’s sales come from overseas, the better its stock has tended to perform this year.

Data from FactSet and S&P Dow Jones Indices show that companies in the top half of the S&P 500 by overseas sales exposure have had a median return of about 16% so far in 2017.

Among those in the bottom half (which includes companies that don’t break out foreign sales—in many cases because they are negligible) the median return is 8%.

So, of the 2000 point rally in the Dow this year, more than half of those points have come from just three stocks – Boeing, Apple and McDonald’s. So just 10% of the Dow provided over 50% of the gains. That narrowness almost guarantees divergence.

At any rate, the overnight rally in Apple took the Dow through the 22,000 barrier on the opening bell. Briefly the other indices went along for the opening rally but they changed their minds in a nano-second. Soon the Russell, S&P and Nasdaq had slipped into negative territory and would struggle there for much of the day. The Dow managed to hang onto plus territory primarily thanks to Apple. Afternoon trading saw volume dry up as the averages undulated trendlessly.

At the close, the Dow held above 22,000 but declines beat advances by about 17 to 11. The telecom sector was the weakest (-1.3%) and energy stocks also closed lower despite a mild rally in crude.

All in all, it has been a great year for cap makers as we have already moved through three thousand point milestones already this year. All on a very narrow base.

Yet Two More Cautions – Jason Goepfert of SentimenTrader noted yet two more cautionary precedents. Here’s a bit of what he wrote:

- Barking with the big dogs. The Dow Industrials continue to reach new heights, while small-cap indexes slide. The Russell 2000 has weakened enough to close below its medium-term 50-day average on Wednesday. The Russell as a leading indicator for the broader market has a mixed record, but when it loses its 50-day while the Dow reached a new high, almost all stock indexes have lost ground over the next couple of weeks.

- The Dow just can’t lose lately. Wednesday marked the 7th straight daily gain for the Dow, and of course, a multi-year high. Remarkably, this is the 4th time in the past 200 days that the Dow has managed a streak like this, the most in its history. The last time it managed even three such streaks was in the summer of 1987, which led to a bit of trouble a couple of months later.