- Moving the Markets

The past few days, I have commented on the fact that the S&P was in danger of notching its first losing month in 2017, and that there was a good chance efforts would be made to push the index in the ‘green.’ That’s exactly what happened and, even though we managed to add only 2 points or +0.08% for August, it will register as a gain in the record books. This is in line with the modest advances we saw in the Dow and Nasdaq.

A couple of econ reports supported the bullish theme with low levels of first-time jobless claims being interpreted as a positive while consumer spending allegedly picked up in July; of course, don’t be surprised if/when these numbers get revised next month.

In regards to our main holdings, we saw International SmallCaps (SCHC) take the lead today with +1.07%. Performing almost just as well were US SmallCaps (SCHA) with a gain of +0.98% and MidCaps (SCHM) adding +0.93%. Lagging the top performers but still closing higher were Transportations (IYT) with +0.13%.

Gold popped nicely after last night’s flash crash, which pulled the metal down below its $1,300 marker, but dip buyers stepped in and were the main contributor to the +1.03% gain. Interest rates dropped again, and the 20-year bond (TLT) continued its march higher by adding +0.30%. The entire month was market by tumbling yields, which was their biggest drop since the middle of 2016. The US dollar (UUP) traded in a wide range but closed lower by -0.29%.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

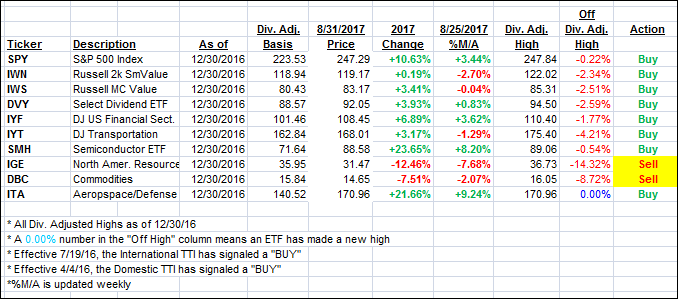

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed higher during the last day of the month, as the rally continued with the major indexes eking out a small gain for August.

Here’s how we closed 8/31/2017:

Domestic TTI: +2.95% (last close +2.61%)—Buy signal effective 4/4/2016

International TTI: +6.38% (last close +5.76%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli