ETF Tracker StatSheet

https://theetfbully.com/2017/06/weekly-statsheet-etf-tracker-newsletter-updated-06292017/

HOVERING ABOVE THE UNCHANGED LINE

[Chart courtesy of MarketWatch.com]- Moving the Markets

The Dow and S&P 500 managed to hang on to slight gains despite a last hour sell-off, which pushed the Nasdaq back into the red for the day. While the major indexes posted had a solid quarter, the month of June was problematic with roller coaster rides in healthcare and technology limiting gains; nevertheless the S&P 500 closed in the green although by only a meager +0.46%.

The Nasdaq was the biggest loser while SmallCaps ended up being the biggest winner. Crude Oil surprised by adding +2.87% for the session and reclaiming its recently lost $46 level. Interest rates rose causing the 20-year T-bond ETF TLT to lose another -0.23%. The US dollar, after having posted 8 month lows yesterday, rebounded a tad with UUP adding +0.16%.

A number of high profile fund managers have recently come out and opined about the extreme evaluations and given forecasts about the precarious situation the economy and the markets find themselves in. Today, it was none other than BofA chiming in with things like:

Central banks have exacerbated inequality via Wall St inflation & Main St deflation“

It is “no longer politically acceptable to stoke Wall St bubble; two ways to cure inequality… you can make the poor richer…or you can make the rich poorer…they have failed to boost wage expectations/inflation expectation, “animal spirits” on Main St… so Fed/ECB now tightening to make Wall St poorer”

And then this:

We don’t think this is “big top” in stocks; greed harder to kill than fear; don’t think this “big top” in stocks, would be surprised if bull market which began with SPX 666 ends before 6666 on the Nasdaq… summer 2017 = significant inflection point in central bank liquidity trade…will likely lead to “Humpty-Dumpty” big fall in market in autumn, in our view.

But Big Top likely occurs when Peak Liquidity meets Peak Profits. We think that’s an autumn not summer story.

We’ll have to wait and see if any of these thoughts become reality, but it would not surprise me one bit.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

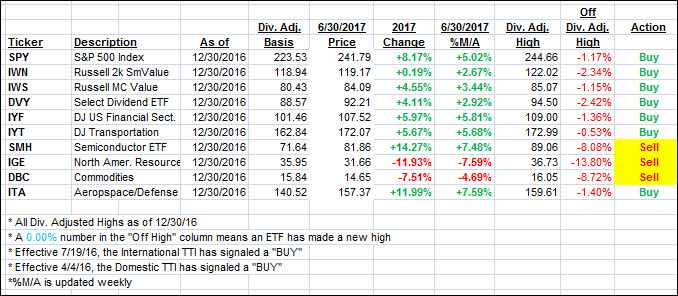

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) dropped slightly as market direction was predominantly sideways.

Here’s how we closed 6/30/2017:

Domestic TTI: +3.01% (last close +3.14%)—Buy signal effective 4/4/2016

International TTI: +6.89% (last close +7.30%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli