ETF Tracker StatSheet

https://theetfbully.com/2017/06/weekly-statsheet-etf-tracker-newsletter-updated-06152017/

AMAZON SLAMS STOCKS BUT MAJOR INDEXES RECOVER

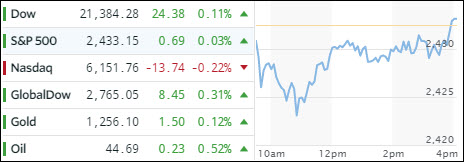

[Chart courtesy of MarketWatch.com]- Moving the Markets

Several events kept the indexes in roller coaster mode. For one, it was quadruple options expiration day, which always tends to add volatility to an otherwise complacent market. That fact got shoved into the background as Amazon announced its acquisition of Whole Foods, which collapsed shares of many grocers not just in the U.S. but also around the world.

Heavyweights like Kroger, Target, Walmart and Costco got slammed with their share prices losing anywhere from -5% to -9% at the close, which was a great improvement over losses early in the session. Pharmacies, drug distributors and REITs were negatively affected as well. The retail ETF XRT joined in and slumped -1.21%.

In the meantime, the economic “hits” continued unabashed with Housing starts suffering its worst streak since January 2009, dropping for the 3rd month in a row (-5.5%) bruising expectations of +4.1%. So, it’s no surprise that building permits also tumbled by -4.9% vs. expectations of +1.7%. Ouch!

In the bigger scheme of things, US economic data has not disappointed this much since August 2011, with the US Macro Surprise Index being hugely disconnected from the stock market as the chart below shows:

Chart courtesy of ZeroHedge

The major indexes managed to climb out of an early hole to conquer the unchanged line late in the session with the exception of the Nasdaq, which closed slightly below it.

Treasury yields were unchanged but the 20-year T-bond ETF TLT managed to eke out a gain of +0.20% for the day. The US dollar ETF UUP reversed, after its 36-hour melt up, and picked up its downtrend again by dropping -0.36%.

For the week, Crude oil continued its slide for the 4th weekly drop in a row, its longest losing streak since August 2015 and closing at a level last seen at election time.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed as the markets were non-directional.

Here’s how we closed 6/16/2017:

Domestic TTI: +3.41% (last close +3.56%)—Buy signal effective 4/4/2016

International TTI: +7.17% (last close +7.11%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli