- Moving the Markets

After the break through the glass ceiling yesterday, the major indexes managed to maintain upward momentum to score gains for the 6th consecutive day recovering all losses sustained during last week’s dump. While the Dow lagged, the S&P and Nasdaq shot up into record territory.

Stocks still felt good the morning after digesting the Fed minutes, disregarding the warnings, and focusing on the hope that Fed members are basically in agreement that there will be a “very gradual and thoughtful balance sheet normalization process.” Some good earnings gave an assist as well.

All this good mojo was enough to push equities higher, which helped traders to simply ignore some bad news, namely that crude oil got spanked at the tune of -5.16% pushing the black gold solidly below the psychologically important $50 level to close at $48.71.

With so much green on the board, bonds joined in and rallied with the 20-year Treasury TLT gaining a tad. The US dollar showed signs of life again with UUP adding +0.12%, and precious metals closed higher as well. Even the VIX, which usually moves opposite of the S&P 500, decided it must be opposite day and edged higher.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

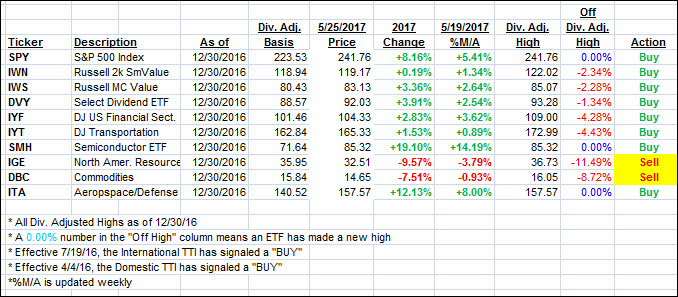

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) moved deeper into bullish territory with the S&P and Nasdaq making new all-time highs.

Here’s how we closed 5/25/2017:

Domestic TTI: +3.78% (last close +3.54%)—Buy signal effective 4/4/2016

International TTI: +8.87% (last close +8.62%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli