ETF Tracker StatSheet

https://theetfbully.com/2017/05/weekly-statsheet-etf-tracker-newsletter-updated-05182017/

BULLARD PUMP DRIVES MARKETS

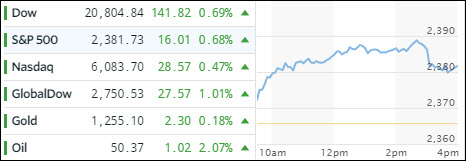

[Chart courtesy of MarketWatch.com]- Moving the Markets

When all else fails, and the markets are in danger of heading south in a big way, it’s nice to know that we can always count on one of the Fed mouthpieces to create an enticing news headline, designed to be picked up by computer algos to push the markets in the desired direction.

Such was the case today, when James Bullard took to the airwaves in a prepared speech saying that “all the talk of an “overheating” economy was just that saying that “financial market readings since the March decision have moved in the opposite direction” of what would normally occur after a rate hike, adding: “this may suggest that the FOMC’s contemplated policy rate path is overly aggressive relative to actual incoming data on U.S. macroeconomic performance.”

Translation: We are not sure if further rate hikes are really warranted as he added that inflation and inflation expectations “have surprised to the downside” and noted that “financial market readings since the March decision have been opposite of expectations.”

That’s exactly what computer algos wanted to ‘hear’ and off to the races we went with the three major averages closing in the green for the day but in red for the week. US Macro data disappointed for the 9th straight week and have now dropped below the election lows as the chart shows:

Source: ZeroHedge

This reading is now the weakest and most disappointing data point since May 2016 and the biggest drop since March 2015, according to ZH. How long will the S&P be able to remain out of sync with reality? Only time will tell.

Of course, in the past couple of years we were able to always count on the Fed and its “correction protection team” to prop up the markets every time they were in danger of moving into bearish territory leaving us with the unanswerable question: How long will that continue?

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

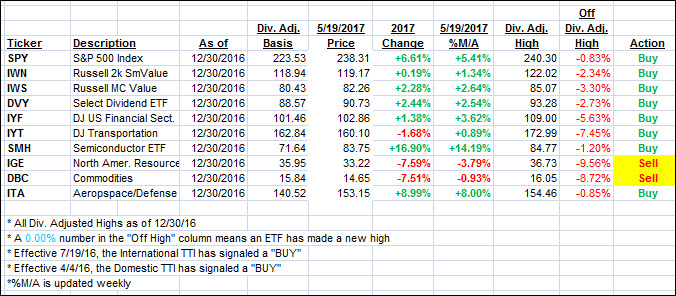

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) inched up as the major indexes continued their rebound for the second day.

Here’s how we closed 5/19/2017:

Domestic TTI: +3.11% (last close +2.97%)—Buy signal effective 4/4/2016

International TTI: +8.06% (last close +7.37%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli