ETF Tracker StatSheet

https://theetfbully.com/2017/05/weekly-statsheet-etf-tracker-newsletter-updated-05112017/

ECONOMIC DATA POINTS CONTINUE TO WEAKEN

[Chart courtesy of MarketWatch.com]- Moving the Markets

The low volatility environment continued as the VIX extended its steak of closing below 11 for 15 consecutive days thereby smashing the previous record. As a result, the major indexes moved in a narrow range, mostly below the unchanged line, appearing to bounce off a glass ceiling all week long.

Equities, with the exception of the Nasdaq, ended in the red for the week with the S&P 500 losing 9 points or -0.33%, a move that is hardly worth mentioning. The retail massacre continued as retail sales missed across the board summarized as follows:

- Retail Sales up 0.4%, missing expectations of +0.6%, up from an upward revised 0.1%

- Retail sales up 4.5% Y/Y, down from 5.2% in April

- Retail sales less autos rose 0.3% in April, est. 0.5%, unchanged from last month’s revised 0.3%

- Retail sales ex-auto dealers, building materials and gasoline stations rose 0.2% in April

- Retail sales ‘control group’ rose 0.2% m/m in April

Source: ZH

Financials were the loser over the last 5 trading days, but tech performed well with the FAANGs (Facebook, Amazon, Apple, Netflix, Google) taking top billing and accounting for most of the gains. Translated, it means that these 5 stocks gained in market cap while the remaining stocks in the S&P 500 ended in the red. Ouch!

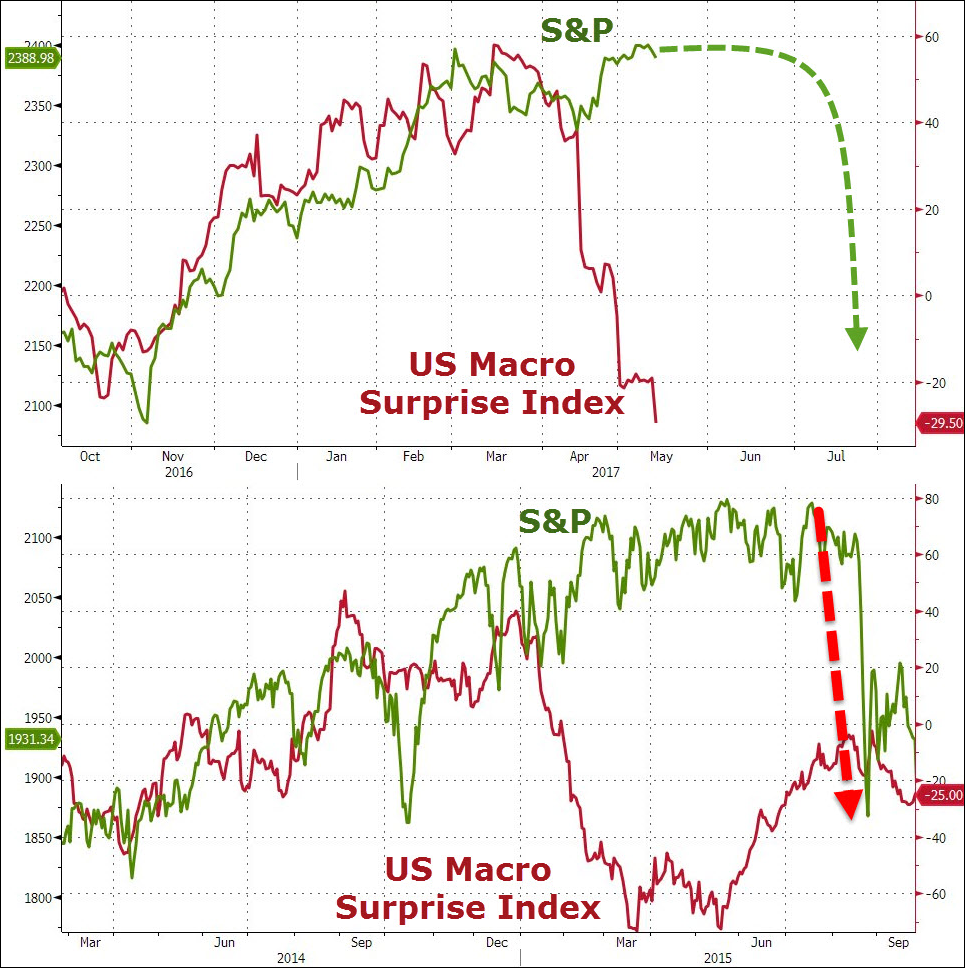

US Macro data has now collapsed for the 8th straight week and has decoupled from reality in similar fashion as it did in 2015. Take a look at these charts and see how that ended up:

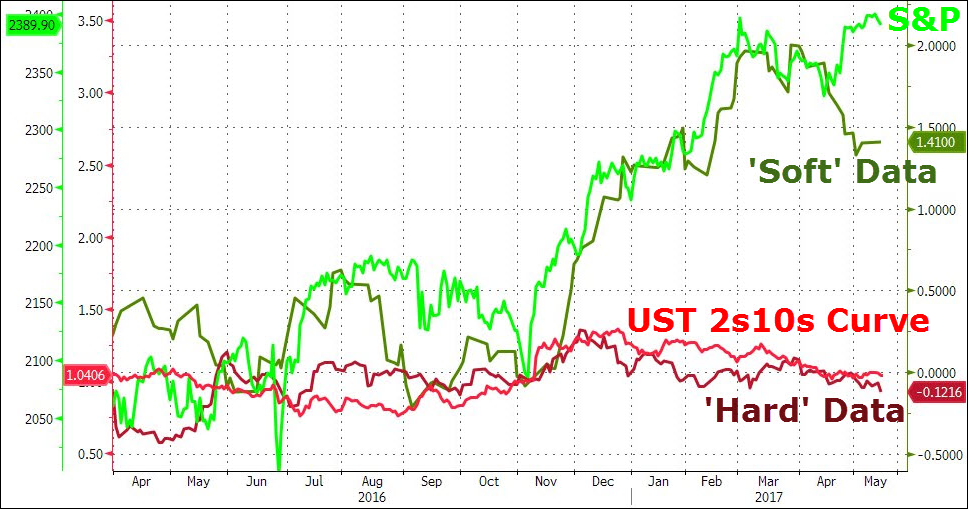

To summarize, all data points, including soft data, have now disconnected from equities:

Source: ZeroHedge

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

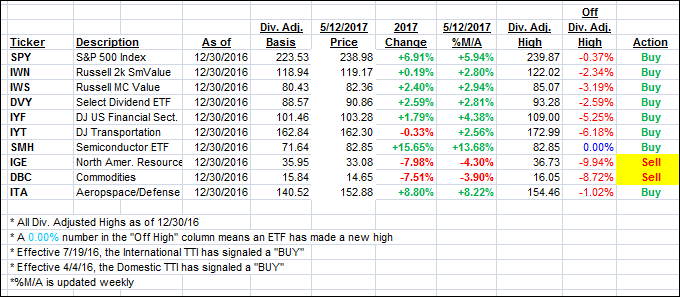

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped a tad as non-directional trading was the theme of the day.

Here’s how we closed 5/12/2017:

Domestic TTI: +3.23% (last close +3.30%)—Buy signal effective 4/4/2016

International TTI: +7.76% (last close +7.95%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli