ETF Tracker StatSheet

https://theetfbully.com/2017/04/weekly-statsheet-etf-tracker-newsletter-updated-04132017/

SLIPPING, SLIDING AND GRINDING

[Chart courtesy of MarketWatch.com]- Moving the Markets

More saber rattling rattled the markets after a 21,000 pound MOAB (Mother of all Bombs) was dropped in Afghanistan to destroy some underground ISIS facilities. At this time, it’s unknown if the damage inflicted was greater in domestic equities than in the intended targets. For sure, early upward momentum vanished in no time and south we went with the major indexes ending in the red during this Holiday shortened week.

With the S&P and Dow now closing at 2-month lows, the question is as to whether the Trump-trade-train has been derailed after much of it was based on hype and hope rather than strengthening fundamentals. While there is no answer to that question yet, some technical damage has been done as all three major indexes have broken their respective 50-day M/As to the downside indicating medium term weakness.

Even good looking headlines for bank earnings failed to create enthusiasm, as a look under the hood revealed more questions than answers, so the bank slide continued with the YTD performance being deep in the red. Treasury yields dropped for the 5th straight week indicating a weakening economy, a viewpoint which I have pounded on for months.

The US dollar rebounded and recouped some of yesterday’s losses with UUP gaining +0.35%. To no surprise, gold and silver gained again with uncertainty gripping the markets, as stocks continue to hover in nosebleed territory as the following chart demonstrates:

Chart courtesy of ZH

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

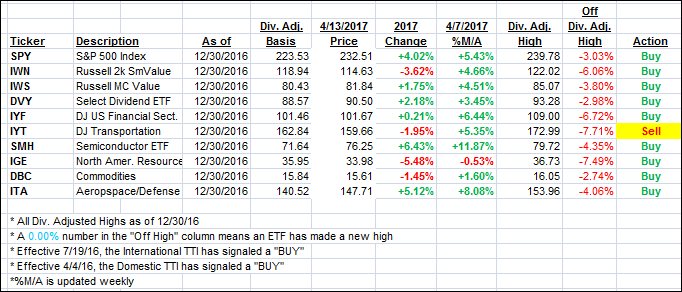

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as nervousness and uncertainty combined to pull the major indexes lower.

Here’s how we closed 4/13/2017:

Domestic TTI: +1.87% (last close +2.16%)—Buy signal effective 4/4/2016

International TTI: +4.13% (last close +4.92%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli