With the recent performance of the S&P, in which there has not been even a single 1% drawdown since the election, not only is complacency raging but some traders have forgotten what it even means to experience a modest 5% correction, let alone a 20% bear market. How much longer can this go on?

For the answer, we turned to a recent report by InvesTech, according to which as the table below shows, a 5% correction has occurred about once every seven months in an ongoing bull market.

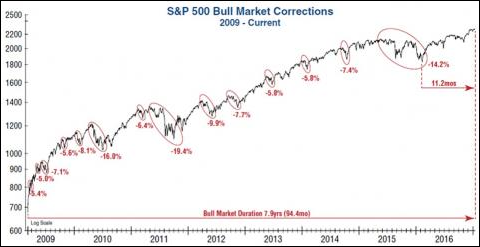

Ignoring that the current bull market is already more than twice the average length of past bull markets with no 20% correction since the financial crisis, the frequency of corrections has been roughly in line with historical norms.

Until recently. As the next chart shows, we are now 11.2 months removed from the bottom of the last correction. Which, to InvesTech means “the market is overdue for at least a 5% correction.”

But the potential for a correction in the next few months is not InvesTech’s only concern. A bigger issue is that – as we have shown countless times in the past – stocks are expensive by virtually every historical standard. In fact, according to an overnight interview by Goldman’s David Kostin, they are “very, very expensive“, which limits the upside potential for this bull market and increases the downside risk when a bear market does eventually arrive.

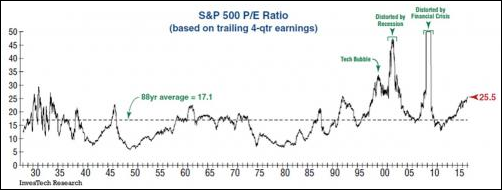

Here are InvesTech’s stats:

The current P/E ratio of the S&P 500 at 25.5 is well above the long-term average of 17.1. In fact, the only times that this ratio has been significantly higher than today were during the Technology Bubble of the late 1990s, together with the distorted period in the subsequent recession, and the 2008-09 Financial Crisis (see graph below). Part of the stimulus for the latest rise in valuations is a market expectation for higher earnings power in the years ahead. However, much of that future growth is already priced into the market and current high valuations must be considered a longer-term risk at these lofty levels.

That said, in a world in which 80% of central banks said they plan on buying more stocks this year, why bother with such trivialities as “valuation” or analysis, when cost-indescriminate central banks who literally print money to buy equities, are perfectly happy to take your stocks off your hands at any price.

Contact Ulli