- Moving the Markets

You could consider this a “non-day” as the major indexes vacillated predominantly above their unchanged lines but ended up as close to zero losses as you can get.

Fallout from Friday’s disclosure by the FBI about resuming the probe into Hillary’s use of an unauthorized email system shifted into high gear and caused more uncertainty about the Democratic’s alleged lead in the presidential elections.

Not helping matters was the Chicago PMI, a measure of economic activity, which hit its lowest reading in 5 months, the upcoming jobs report this Friday as well as the ongoing 2-day Fed meeting about possible rate hikes, the verdict of which will be read on Wednesday. Given that, I don’t see the markets going anywhere until clarification on these matters surfaces.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

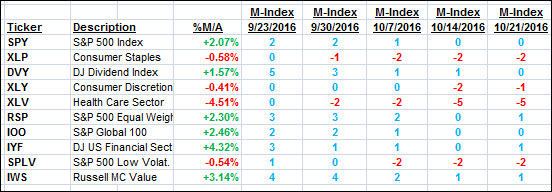

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

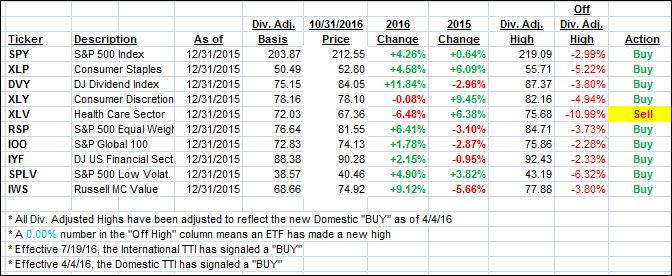

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed as the markets closed just about unchanged.

Here’s how we closed 10/31/2016:

Domestic TTI: +0.76% (last close +0.77%)—Buy signal effective 4/4/2016

International TTI: +2.43% (last close +2.64%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli