Remember when “bad news is good news” first leapt into common parlance? At first it was used as a way to describe the reaction function of Fed policy-makers. It was taken as a cute turn of phrase in encapsulating the state of the world. Over time, as Bloomberg’s Richard Breslow explains, it’s morphed into an ugly and cynical way of justifying mindless investing behavior.

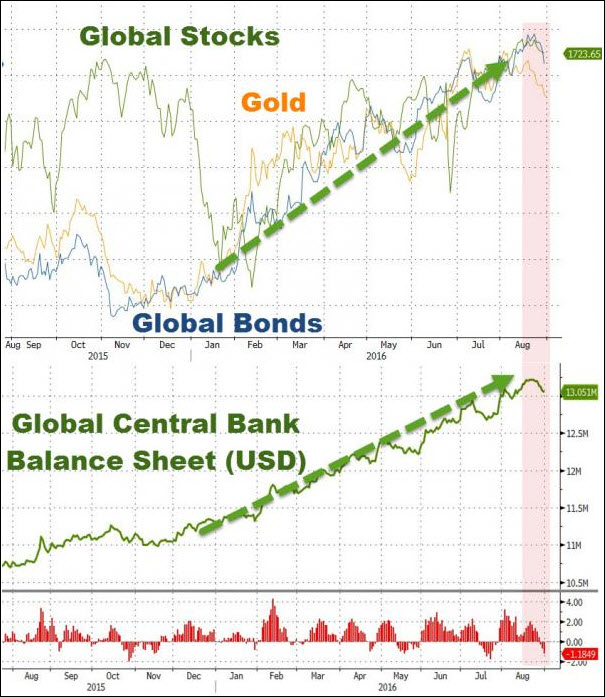

Central banks that cultivated and encouraged irrational exuberance as their main transmission mechanism of monetary policy are now hopelessly caught in its infinite loop. Seemingly feeling the need to continue doing more of the same, no matter the efficacy.

Too many investors now believe, or hope, there will be no policy reversal for the balance of their careers. They explain the world in terms that justify the status quo. It’s become their world view and they’re sticking with it and hope to get out of town before the market gets trickier.

It’s a sad commentary, that the term was actually coined by two psychologists in the 1990s studying faults in human decision-making.

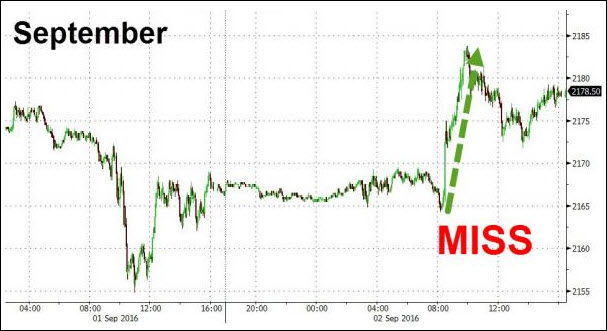

After last Friday’s non-farm payroll report (9/2/16), analyst’s joyfully leapt to the hasty conclusion that it was sure to once again derail a hapless FOMC. No one dare seriously consider September as a legitimate possibility. No discussion of probabilities. The answer is no. Happy days.

Wait for it. Wait for it. There they were. Banner headlines celebrating, “Jobs data saves the day,” “SPX surges on payrolls.”

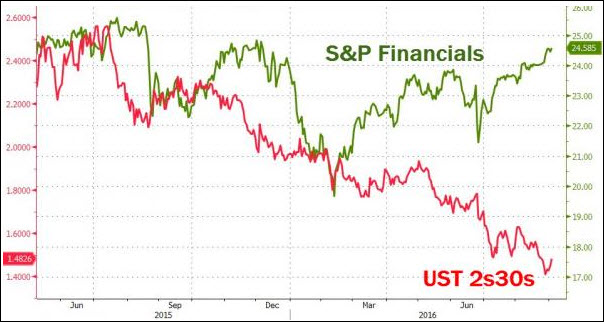

And the good feelings have carried through the weekend with “Asian stocks rally most in eight weeks on weak U.S. jobs data.” Ignore bond yields, what do they know, anyway?

Departing India RBI Governor Raghuram Rajan reminded us over the weekend that low global interest rates risk distorting markets and are very hard to abandon. That countries become “trapped” by the fear that rate rises could harm growth.

He was not arguing that, therefore, any excuse not to raise rates should be sought. Quite the contrary. Nor was Fed Chair Yellen when she said the case for higher interest rates had strengthened.

Forward guidance may be lower for longer, but it most certainly has moved away from nothing for as far as the eye can see. And Kahneman and Tversky would have pointed out that Behavioral Economics isn’t the study of the Pavlovian Response.

Contact Ulli