ETF Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

DULL FRIDAY, POSITIVE WEEK

1. Moving the Markets

Stocks ended lower today after three straight days of gains as momentum from the Fed’s decision Wednesday to chicken out on any interest rate hike this month slowed. Despite Friday’s drop, all three major indexes posted gains for the week.

Rumor in the tech world has it that social-media giant Twitter could perhaps receive an acquisition bid, possibly from Salesforce (CRM) or Google (GOOGL). Twitter (TWTR) shares soared almost 20% for the day closing at $22.62 a share. While the daily gain may seem notable, the stock is just $0.10 above the beginning of the year price of $22.56 a share.

Oil prices were a bit volatile today, getting hammered in early trading before paring those losses on hopes of a deal between Iran and Saudi Arabia. Although Saudi Arabia reportedly offered to slash production if Iran freezes their production, few oil industry observers expect a lasting agreement and prices fell sharply once again with oil losing 3.48% on the day.

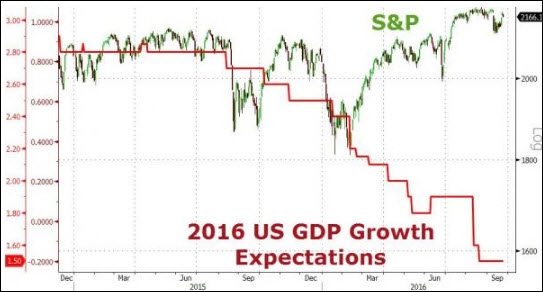

Moving forward, not just news surrounding the Fed’s decision regarding interest rates will likely create short-term volatility but also continued weaker economic reports the latest of which pointed to the lowest GDP growth since the financial crisis as a slowdown in manufacturing activity confirmed. In the end, you just have to wonder how long this manipulated market can remain disconnected from the underlying GDP reality. Take a look at this updated chart:

Chart courtesy of ZeroHedge

Chart courtesy of ZeroHedge

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

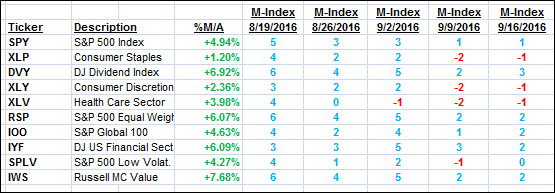

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

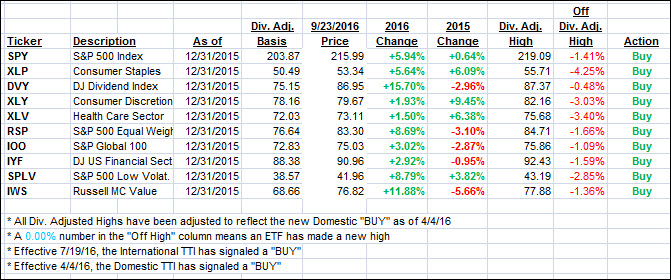

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Both of our Trend Tracking Indexes (TTIs) ended the week higher with the more volatile International one taking a large jump deeper into bullish territory.

Here’s how we closed 9/23/2016:

Domestic TTI: +2.48% (last Friday +2.03%)—Buy signal effective 4/4/2016

International TTI: +5.12% (last Friday +3.02%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli