ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

FRANCE INCIDENT PULLS MARKETS LOWER TO END THE WEEK

1. Moving the Markets

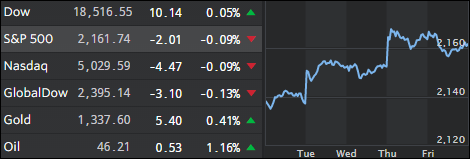

The stock market here in the U.S. ended mixed Friday, despite some decent economic and earnings news this week, as the mood of the market was pulled down by the latest terror attack in France.

As you may know, the market has been on a record-setting run since the Brexit vote. Overnight in France, however, a driver of a truck ran down pedestrians, killing 84 people and injuring many more. The latest strike in France, presumed a terror attack, raises fresh questions about global security. Events such as these can “spook” markets the day or two after they happen and this time was no different.

In earning news, Citigroup (C), despite a 14% drop in quarterly earnings vs. a year ago, topped both earnings and revenue projections. The company’s shares lost 0.3% though despite the earnings beat. Wells Fargo’s (WFC) quarterly results came in equal to expectations and shares subsequently fell 2.5%.

In China, second-quarter economic growth allegedly clocked in at 6.7%, unchanged from Q1 2016, but above economists’ forecast. Stabilization in the Chinese economy, engineered to a great degree by stimulus efforts of policy makers, is another plus for so-called risk assets, such as stocks. Here in the U.S., June retail sales in the U.S. rose a solid 0.6%, well above the 0.1% rise expected, although the fly in the ointment was that it came from a decidedly weaker than initially reported May.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

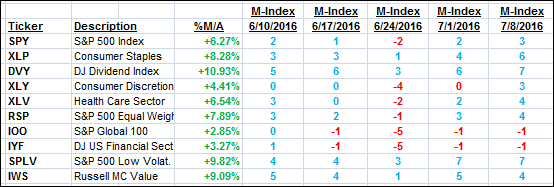

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

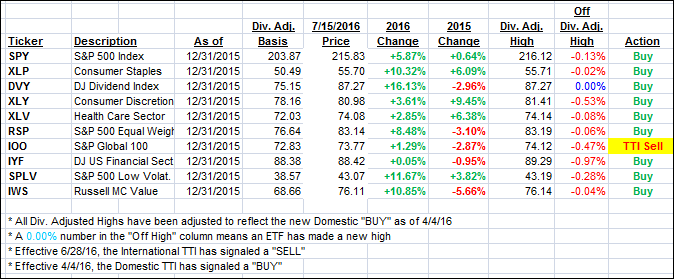

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) edged higher this week while the International one took a jump, as I previously posted. I will wait a few more days to see if this move shows staying power above the line before considering the current bearish cycle to be over.

Here’s how we ended this week:

Domestic TTI: +2.60% (last Friday +2.42%)—Buy signal effective 4/4/2016

International TTI: +1.80% (last Friday -0.77%)—Sell signal effective 6/28/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli