1. Moving the Markets

U.S. and European stocks rallied big time as investors appear to be front running or betting that voters in the U.K. will choose to remain in the European Union. Ahead of the vote, a new Ipsos Mori poll completed Wednesday night showed the “remain” supporters with a narrow lead — 52% to 48%. But the polling firm’s chief executive said 13% of those polled could change their minds.

With the HFT traders dominating market action, I would not read too much into this move as volume was utterly atrocious. On the other hand, things like lack of volume or slowing worldwide economies with ever increasing debt loads no longer matter in this run towards new all-time highs, until… one day… they do. Then, watch out below…

What investors do know, based on market action leading up to the closely watched vote, is that a vote by Britain to exit the E.U. – the feared Brexit – would deliver a bearish blow to so-called risk assets, which include stocks.

We also heard today that Bank of America (BAC), the nation’s largest bank, has agreed to pay $430 million in settlements for violations of regulatory rules that safeguard customer funds. Apparently, the bank misused brokerage customers’ cash from 2009 to 2012 to finance its own trading and generate profits, the SEC said. This is a reminder to always read disclosures thoroughly; I am sure everybody does.

Lastly, news came in that German automaker Volkswagen Group is expected to deliver a $10 billion settlement to cover government fines and compensate owners of vehicles fitted with software that cheated emissions standards, according to multiple reports.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

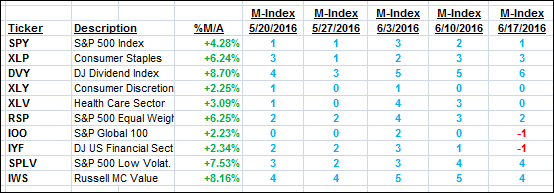

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

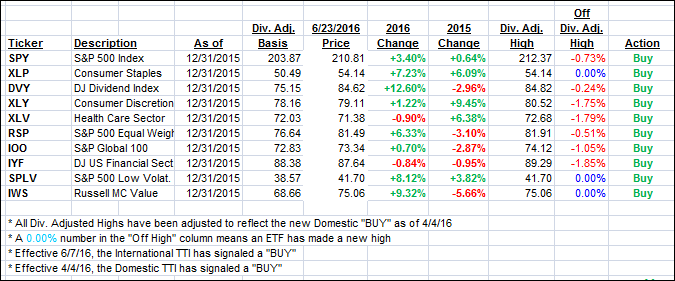

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) took a jump as the HFT machines pushed world markets higher in anticipation of a “Remain” victory vote in the Brexit battle. The International TTI jumped sharply as well as you can see below.

Once the votes are all counted, I am curious to see if the adage “Buy the rumor, sell the news” comes true again.

Here’s how we closed:

Domestic TTI: +2.03% (last close +1.54%)—Buy signal effective 4/4/2016

International TTI: +2.38% (last close +0.88%)—Buy signal effective 6/7/2016

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli