ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

MARKETS END WEEK ON A DULL NOTE

1. Moving the Markets

Although all 3 major indexes ended in the red, we heard some positive news that retail sales rebounded in April and jumped 1.3% after dropping 0.3% in March. It is the largest rise in 13 months and the increase was partly due to higher gasoline prices and auto sales. Retail sales, excluding gas and autos, rose 0.6%. Names like Nordstrom (JWN) and J.C. Penny (JCP) reported poor earnings figures today, however, the big beat on overall retail sales figures for April suggests that there has been allegedly resurgence in consumption, following a weak first quarter.

Major U.S. stock indexes have also been hit by a continued fall in shares of tech giant Apple (AAPL). The stock remains under pressure following its sub-par Q1 earnings report in late April that showed the first-ever quarterly decline in iPhone sales due to a maturing smart phone space. Apple was briefly supplanted Thursday as the world’s most valuable company measured by market value by Google (GOOGL) parent Alphabet. Apple shares are down 14.2% in 2016 and have fallen 2.6% so far this week heading into Friday’s trading.

The price of U.S.-produced crude was also in retreat, falling 55 cents, or 1.1%, to $46.19 a barrel. The $46.19 mark still maintains a continued long-term upward movement.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

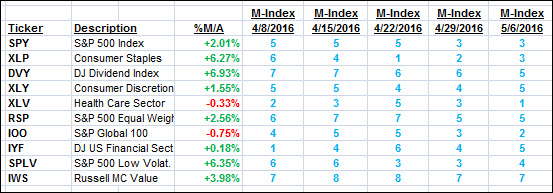

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

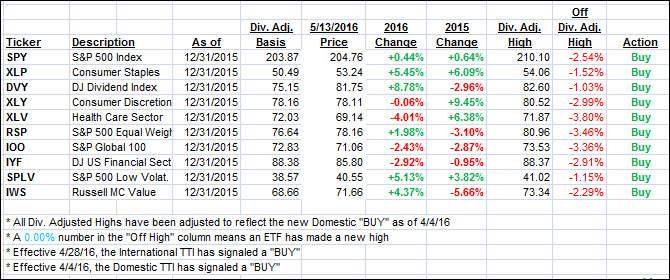

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) retreated again but remained on the bullish side of its trend line.

However, the International TTI took a dive confirming that this short Buy cycle appears to have come to an end. Downward momentum has worsened and, unless the markets stage a big rebound on Monday morning, the “Sell” signal will be in effect as of 5/16/16.

Here’s how we closed this Friday:

Domestic TTI: +1.03% (last Friday +1.11%)—Buy signal effective 4/4/2016

International TTI: -1.72% (last Friday -1.08%)—Sell signal effective 5/16/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli