ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

VOLATILITY REMAINS AT THE FOREFRONT TO END FIRST WEEK OF TRADING

1. Moving the Markets

It has been a volatile week needless to say; however, markets have not lost too much momentum with the S&P gaining for the day but losing some 1.2% for the week. The S&P 500 and Dow both remain in the black for the year, but the upcoming earnings season will be a big determinant as to how stock performance may sway over the next quarter. It all depends how the much lowered earnings expectations (along with future outlook) are received and if these numbers can be beat due to the bar having been set extremely low.

Today, the boost in oil prices initially boosted sentiment on Wall Street and pushed the Dow up sharply in morning trading, but the gains could not sustain and the markets gained only modestly on the day after falling from grace in the early afternoon.

Energy stocks led the gains as U.S. benchmark crude gained $2.27 to $39.53 a barrel and got within striking distance of the key $40-per-barrel level.

Let’s look forward to the upcoming earnings season with Alcoa (AA) reporting first.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

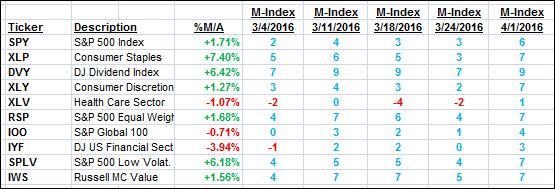

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

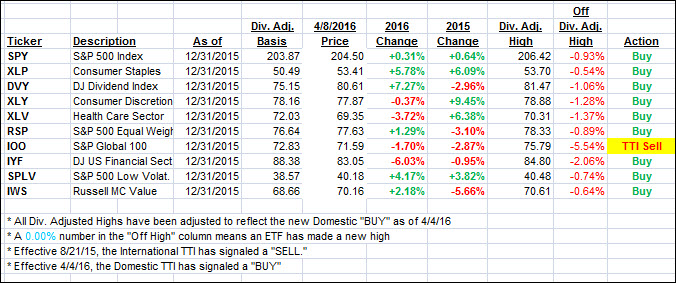

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) vacillated with the major indexes all week but ended barely changed. We’re holding on our limited equity positions.

Here’s how we ended this week:

Domestic TTI: +1.19% (last Friday +1.25%)—Buy signal effective 4/4/2016

International TTI: -2.72% (last Friday -2.25%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Smokey:

Q: Ulli: In this market cycle dating from your most recent sell signal until 4/4/16, I have held all of my positions. Those who follow your suggestions, no doubt, got out of the market at your alert signal. As of today, both they and I are at the same place in the market, assuming they are all back in, now. The difference, in my mind is that I have mirrored their performance without creating a taxable event. Comment?

A: Smokey: Yes, while you are correct, you are also extremely lucky in that the markets did not collapse in mid-February as the Fed’s jawboning prevented the S&P 500 from slicing below the 1,800 level. The subsequent rebound saved many buy and holders from losing their shirt.

Had you done what you did back in July of 2008, you would have suffered severe financial hardship. I for one will not take any chances that next time the market tanks we will get lucky again and see a repeat rally of March 2016.

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli