ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

RUNNING OUT OF STEAM

1. Moving the Markets

Coming off one of the worst day for stocks since early February, domestic shares were under pressure again today. Investors have been reacting to mixed earnings reports and maybe, just maybe, the realization is sinking in that the economy is simply underperforming.

Despite the sloppy finish to the week, the Dow and S&P 500 ended April with tiny gains, with the Dow up 0.5% for the month and the S&P 0.3%. The Nasdaq did not fare nearly as well, falling 1.9% in April.

Wall Street, of course, is coping with the worst stretch for corporate profits since 2008, with earnings on track for a third straight quarter of negative growth. While there have been big beats, such as Facebook (FB) and Amazon.com (AMZN), there also have been a number of disappointments by major players ranging from Apple (AAPL) to Google parent Alphabet (GOOG).

In earnings reports Friday, oil giant Exxon Mobil (XOM) said profit fell 63% but still topped very low earnings expectations, posting earnings per share of 43 cents, topping the 31 cents forecast. Exxon Mobil, which has been savaged by the drop in oil prices to 13-year lows back in mid-February, posted revenues of $48.71 billion, which also topped estimates. Chevron, however, fell short of profit expectations but beat revenue expectations.

Investors are still digesting recent decisions by the U.S. Federal Reserve to hold off on interest rate hikes, and a surprise decision yesterday by the Bank of Japan not to inject more stimulus into its ailing economy.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

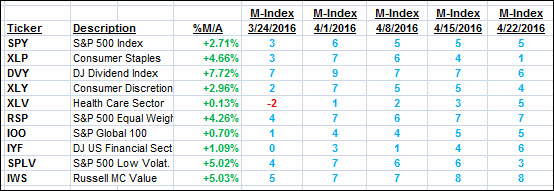

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

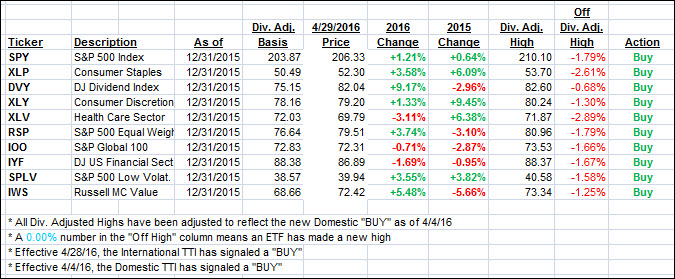

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) retreated with the International one coming dangerously close to breaking below its long-term trend line again, which was the result of the markets folding over the past couple of days. If this reversal continues, we may very well have a whip-saw signal in the making.

Here’s how we closed this Friday:

Domestic TTI: +1.29% (last Friday +1.74%)—Buy signal effective 4/4/2016

International TTI: +0.46% (last Friday +0.88%)—Buy signal effective 4/28/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli