ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

EQUITIES POST THIRD STRAIGHT WEEK OF GAINS

1. Moving the Markets

Stocks rallied Friday to log a third straight week of gains after the February jobs report came in stronger than expected, signaling that the economy continues to grow despite slowing growth overseas and early-year financial turbulence.

Of course, as usual, the surface number of 242,000 (vs. 195,000 expected) generated a lot of enthusiasm, but when looking under the hood it showed that over 80% of the newly created jobs belonged to the lowest paying categories like retail, bartenders and waitresses; hardly awe inspiring but certainly indicative of the current economic environment.

In addition, and to add insult to injury, during the month of February average weekly earnings dropped 0.7%, the largest ever.

However, in the end, none of that mattered as the indexes, while slowing down their torrid pace, continued on their upward trajectory this week with the S&P 500 adding +2.67% and closing just shy of the 2,000 mark. The Dow Jones Industrial Average also notched its first four-session winning streak since October with the oil rally, based on hope that a bottom has been made, supplying the powder for this explosive bear market move.

With the jobs report having come in above expectations, at least the headline number, the big open questions it remains as to whether this will be enough to keep the Fed on target with their next scheduled interest hike later on this month.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

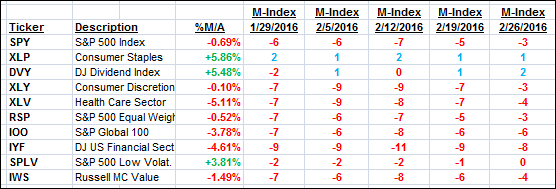

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

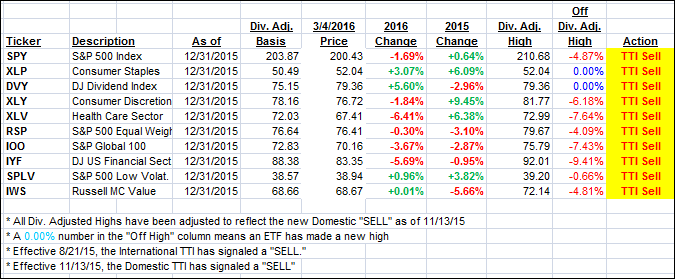

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) improved quite a bit during this week’s rally continuation. While we’re still positioned on the bearish side of the trend line, a crossing to the upside is now a distinct possibility; however, we need to look for a clear piercing along with some staying power before considering this bearish period to be over.

Here’s how we ended this week:

Domestic TTI: -0.41% (last Friday -1.27%)—Sell signal effective 11/13/2015

International TTI: -4.63% (last Friday -7.93%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli