ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

STOCKS POST STRONG TURNAROUND TO CLOSE VOLATILE WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks on Wall Street staged a powerful comeback after plunging early Friday as investors reacted to a weaker-than-expected September jobs report. The Dow was down as much as 258 points but did a complete turnaround closing up 200 points by the closing bell. Major indexes were higher on the week with the energy sector showing relative strength and the telecom sector showing relative weakness.

To close out the week, it appears that investors are shrugging off a downright miserable jobs report, instead focusing on the positives, such as the positive impact of a weakening dollar today on business and earnings of U.S. multinationals. Wall Street may also be reacting to what it perceives now as no chance of an interest rate hike from the Federal Reserve this year.

The marquee data release this week was the jobs report. The Bureau of Labor Statistics reported that the economy added 142,000 jobs in September—well below economists’ consensus estimate of 200,000. Additionally, employment gains for both the months of August and July were revised down by an aggregate of 59,000. While this data is disappointing, what’s worse is that about 20% of the gains came from government hiring.

Next week will be a relatively slow week for U.S. economic data, with the most important release being the Fed’s September meeting minutes on Thursday. We will also be watching the trade balance figures closely on Tuesday.

With today’s rebound, it’s no surprise that all of our 10 ETFs in the Spotlight rallied and closed up. Turning in the best scorecard for the day was Healthcare (XLV) with +2.08%. Lagging the bunch were the Financials (IYF) with a meager +0.13%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

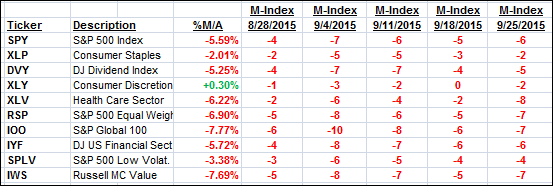

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

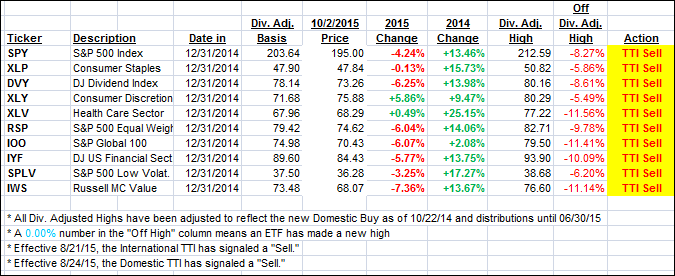

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) improved this week as Friday’s powerful rebound gave the bulls some hope. It remains to be seen if this rally turns into another dead-cat-bounce once the bad-news-is-good-news scenario (employment numbers) loses its luster and reality sets in.

Here’s how we closed:

Domestic TTI: -1.90% (last Friday -2.49%)—Sell signal effective 8/24/2015

International TTI: -6.67% (last Friday -7.56%)—Sell signal effective 8/21/2015

Until the respective trend lines get clearly broken to the upside, we are staying on the sidelines.

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli