ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

MARKETS CLOSE QUIETLY HIGHER IN ANTICIPATION OF FED DECISION

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Wall Street’s last session of the week was marked by a cautious tone, with stock prices cutting early losses and ending higher as traders awaited next week’s key decision on interest rates from the Federal Reserve. Traders’ trepidation over whether or not the Fed will hike rates for the first time in more than a decade when it breaks from its two-day policy meeting Thursday has Wall Street playing it conservatively and safe today. No one is willing to make a big bet ahead of the closely watched decision.

Adding to the angst on Wall Street of late was a research report from Goldman Sachs today that said there is a chance for U.S.-produced crude oil to dip as low as $20 a barrel due to persistent oversupply and lower demand expected from slowing emerging market economies. Oil prices have dropped in half over the last 12 months as the market adjusts to a global surplus and an economic slowdown in China. The emergence of new sources of oil from the U.S., where producers are tapping shale reserves, has also fueled the recent decline.

After a month of volatility and an announcement it will close dozens of under-performing stores, Macy’s (M) announced earlier this week that it will soon open Best Buy (BBY) shops within some of its department stores as a way to test selling consumer electronics. The rollout will begin in 10 Macy’s stores across the country starting in November. Macy’s Inc. President Jeff Gennette said that the companies will test the stores through the holidays and into 2016 before deciding on the next steps.

All of our 10 ETFs in the Spotlight inched higher as the indexes vacillated within a trading range. The bias was up, however, with the leader of the day being Consumer Discretionaries (XLY), which added +0.75%, while the Global 100 (IOO) lagged with +0.17%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

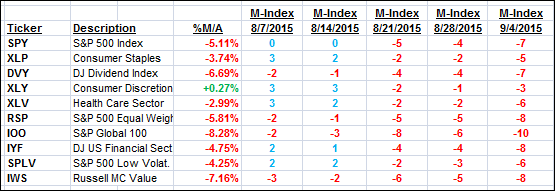

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

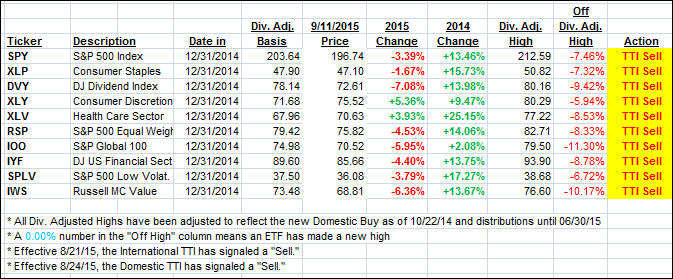

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) improved from last week as the major indexes staged a slight recovery, but we’re still stuck in bear market territory by the following percentages:

Domestic TTI: -1.79% (last Friday -2.70%)—Sell signal effective 8/24/2015

International TTI: -5.27% (last Friday -6.89%)—Sell signal effective 8/21/2015

Until the respective trend lines get clearly broken to the upside, we are staying on the sidelines.

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Don:

Q: Ulli: Thanks again for all the info you provide. Since no one knows if this is short-term correction or the beginning of a bear market we all depend on your expertise to guide us.

When a buy signal is triggered, will you use the same ETFs that you were using in your portfolio or will you use the M-Index to determine if some or all should be replaced at that time?

Also, do you invest in equal amounts in each ETF? I would think that would be the proper way since you are not trying to diversify the portfolio.

Thank you for your time all the info you give us.

A: Don: It all depends when the next Buy signal is triggered. If it happens fairly fast, such as it did last October, I used the same ETFs we owned before. If, on the other hand, we sink deeper into this bear market, and some time passes, I will re-evaluate and consult my High Volume ETF list at that time.

As far as individual allocation is concerned, I sometimes have favorites, so I don’t necessarily invest equal amounts. For example, during the last Buy cycle we had a larger allocation to Healthcare, which performed very well and helped average out the performance of those ETFs that were less than stellar.

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli