ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

A SECOND STRAIGHT LOSING WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

It was a volatile Holiday-shortened week with the major indexes succumbing to the bearish forces again. As I reported the past four days, the culprit was Greece and its unresolved debt problems along with its referendum scheduled for this coming Sunday. Any surprise outcome in regards to its eurozone membership will surely affect the markets, but very likely more so in Europe than here is the U.S.

On the domestic side, we saw today’s mixed jobs report which, along with weekly unemployment claims came in weaker than expected. While the unemployment rate slipped to 5.3% 223,000 new jobs were added but, unfortunately, the estimated numbers for April and May were sharply reduced and more people left the labor force. It was a report that certainly did not give much ammunition to the Fed in terms of justifying an interest rate increase in the near future.

9 of our 10 ETFs in the Spotlight slipped as the bears maintained the upper hand this week. Only the Dividend ETF (DVY) managed to squeeze out a gain of 0.33% during yesterday’s low volume pre-Holiday session.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

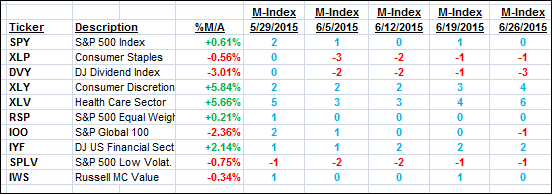

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

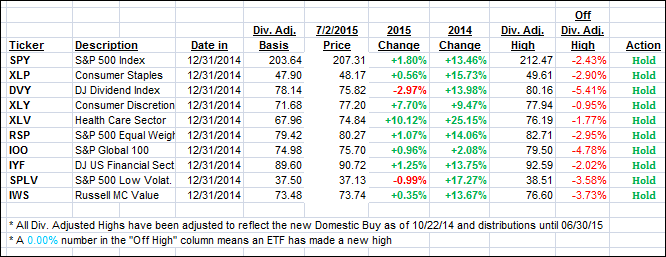

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) showed weakness during this past week, as both indicators headed closer towards their respective trend lines. To no surprise, the International one got hit hardest as a result of the potential fallout from the Greek crisis.

Domestic TTI: +0.92% (last Friday +1.61%)—Buy signal effective 10/22/2014

International TTI: +1.67% (last Friday +3.35%)—Buy signal effective 2/13/2015

Have a nice 4th of July weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli