ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, April 10, 2015

STOCKS END THE WEEK ON A SOLID NOTE; BLACKSTONE DEAL GOES THROUGH

[Chart courtesy of MarketWatch.com]- Moving the Markets

Stocks rose for a third straight day Friday as the Dow rallied nearly 100 points and jumped back above the 18,000 level to close out with a weekly gain. The entire buzz today was about the General Electric deal.

As you may remember from earlier this week, there was speculation that Blackstone Group (BX) and Wells Fargo (WFC) were going to make an offer on a substantial real estate portfolio of General Electric (GE). Well, today General Electric announced it is selling the bulk of its GE Capital Banking business in its latest attempt to “simplify” its manufacturing business and concentrate on the best-performing segments.

The $23 billion deal, covering both GE Capital Banking and Real Estate, marks the largest real estate transaction since the 2007 recession. Separately, Blackstone Property Partners agreed to a $2 billion, all-cash acquisition of Excel Trust (EXL), a San Diego-based real estate investment trust that primarily targets shopping centers and grocery store-anchored investments.

In corporate earnings, the outlook for 2015 remains bleak, as Q1 earnings for the S&P 500 index are still expected to come in 4.7% lower and forecast Q2 earnings are expected to be 2.1% lower, according to Bloomberg.

For the week, we saw few major economic reports. The most impactful update was the March unemployment report, which was actually released on last Friday. U.S. economic data has seemed to weaken in recent months; however, economists expect the slowdown to allegedly prove temporary, as economic growth is expected to come in between 2.5% to 3% for the year, a stronger pace than most developed economies around the world.

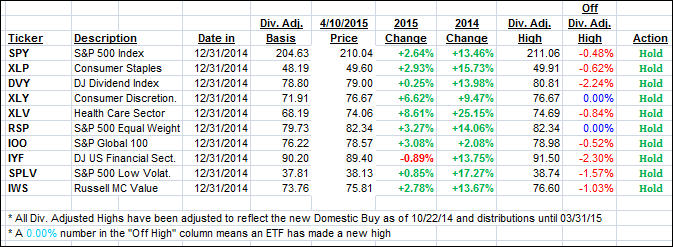

All of our 10 ETFs in the Spotlight gained with healthcare (XLV) taking the lead today with +0.86%, while the financials (IYF) ended unchanged. 2 of the 10 made new highs for the year as you can see section 2.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

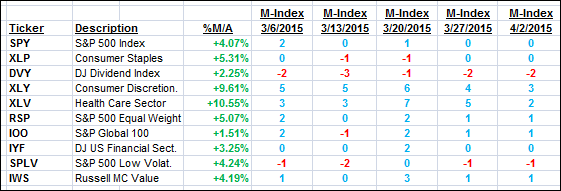

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) advanced and ended up deeper on the bullish side of their respective trend lines:

Domestic TTI: +3.31% (last Friday +2.74%)—Buy signal effective 10/22/2014

International TTI: +4.95% (last Friday +3.83%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Chris:

Q: Ulli: Do you ever decide to “take profits” on one of your 10 ETFs in apparent bubble conditions or instead wait and let the TTI’s help decide what to do?

For example, the biotech sector has been skyrocketing the past couple of years e.g. IBB ETF. The healthcare XLV ETF is considered a somewhat low beta ETF, but with that said, does have a decent % of biotech companies in its portfolio holdings.

I’m not sure on the exact %, but a few websites average to somewhere around 15-20% allocated to biotech companies in the XLV, which might provide a lot of volatility for this ETF if something were to disrupt the biotech industry e.g. Obamacare repeal, new gov. regulations etc.

A: Chris: I don’t like to make wild guesses about the direction of any ETFs I own; I like to use clearly defined price points to make my decisions for me. Most of the time, a trailing sell stop will be triggered before a trend line crossing occurs. When some ETFs rally strongly, such as biotechs and others, their respective trailing sell stops serve 2 purposes:

- To limit downside risk should a sell off occur shortly after a purchase has been made, and

- To lock in profits once an ETF has shot into the stratosphere and is bound to correct more quickly than others

It does not matter what the reasons for a sell-off are, I simply prefer having the sell stops be my guide as to whether to exit or not, rather than me trying to make an educated guess. Remember, one of the reasons we engage in Trend Tracking is to take the emotions out of the equation and become less attached to the decision making process.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli