ETF/No Load Fund Tracker Newsletter For January 23, 2015

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, January 23, 2015

A DISAPPOINTING FINISH TO A FRUITFUL WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks ended lower today but higher on the week, led primarily by the technology sector. Pushing markets higher in general was news from the European Central Bank. Earlier this week the ECB announced a larger-than-expected asset purchase (bond buying) program. The ECB plans to purchase at least €1.1 trillion (about $1.3 trillion) in investment-grade bonds and asset-backed securities from the secondary market, at least until September 2016. This is an attempt to spur economic growth to increase low inflation to the ECB’s 2% target.

In IPO news today, shares of online file sharing service Box (BOX) jumped more than 65% in their first day of trading. The initial price of the 12.5 million shares that were sold was set at $14 a share; however, the deal had been delayed for months. The company raised $175 million from its IPO and has clients such as General Electric (GE).

The highlight of the upcoming week will arrive on Wednesday, as the Federal Reserve FOMC two-day policy meeting ends and is followed by an announcement. The Fed has recently stated it would remain “patient” in increasing short-term policy rates as global economic growth has slowed and as inflation has stalled due to declining energy prices. Expectations are still for a midyear rate increase. Wall Street will certainly be looking for any change in the Fed’s statement.

All of our 10 ETFs in the Spotlight slipped today but most gained for the week. 6 of our funds remain on the plus side YTD as section 2 shows.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

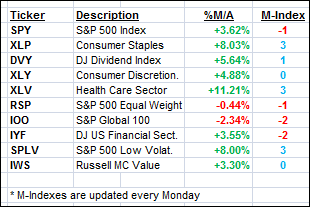

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For more ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

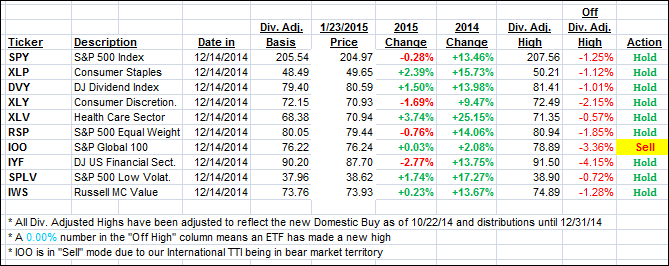

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) improved as this week’s rebound gathered steam. Today’s close was weak and can likely be attributed to some jitteriness ahead of the Greek elections this weekend.

Here’s how we ended up:

Domestic TTI: +2.81% (last Friday +2.20%)—Buy signal since 10/22/2014

International TTI: -0.47% (last Friday -1.93%)—Sell signal effective 12/15/14

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Angela:

Q: Ulli: If I buy a stock at $50.00 and then, the stock goes up to $70.00, then it starts sliding down; if I am using a 7% SELL STOP, then I will be getting out at $65.10. This is all good, but my problem is that I don’t have the time, discipline to track and execute this transaction.

However, I have an option through my brokerage account to place a trade called “trailing stop on quote.”

I could place this type of order when the price of the stock reaches $70.00. There are two trail options, one is a percentage or points (price). Which one should I use? What do you thing about using this type of trade to track by sell stops.

Thanks for your help.

A: Angela: There are various issues here.

First, my sell stop discipline does not work with individual stocks very well, since they are too volatile. My exit strategy is designed to be applied to broadly diversified mutual funds and ETFs.

Second, you need to track the high prices of your ETF/mutual fund every day. Say, you reach the $70 level, and then the price slips to $68 before resuming its trend and touching $72. Then $72 becomes your new high price from which to calculate your sell stop. You can’t do that with an automated system such as you describe.

Third, as I posted on various occasions, we only used day-ending prices for our calculations in order to avoid intra-day whipsaw signals and/or market manipulation.

Having said that, you should be able to take a couple minutes at night to see if your sell stop, based on that day’s closing price, has been triggered or not. If it has, then you can place your order the next morning.

Hope this helps.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli