1. Moving the Markets

Markets ended mostly lower today, with tech stocks making a big drag, especially Apple (AAPL). The S&P 500 dropped a slight 0.06%, the Nasdaq fell 0.55% and the Dow was the only major index that gain, closing up 0.06%. There seems to be notable anticipation from investors regarding the European Central Bank’s upcoming policy meeting.

Also, in international news, investors were initially encouraged today by news that Russia and Ukraine were discussing a cease-fire agreement and had agreed to a framework to settle the conflict. But markets were unable to hold on to the gains and steadily drifted lower with losses accelerating late in the day.

In tech news, Samsung Electronics Co Ltd announced that is has launched a virtual reality headset for its new Galaxy Note 4 tablet using technology from Oculus VR, a company that Facebook Inc (FB) recently acquired for $2 billion.

7 of our 10 ETFs in the Spotlight gained with 3 of them making new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

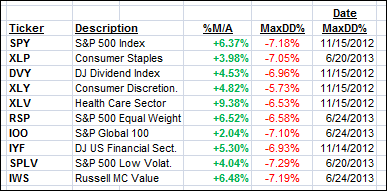

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

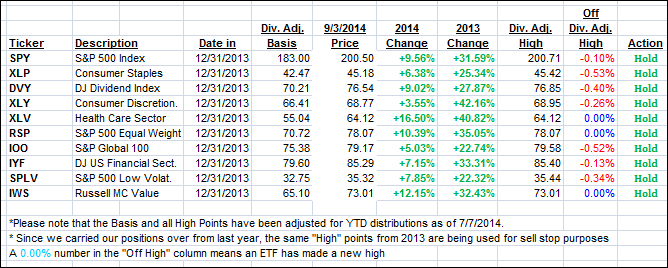

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic TTI slipping and the International TTI gaining:

Domestic TTI: +3.09% (last close +3.20%)

International TTI: +3.12% (last close +2.71%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 2

Regarding the 2 tables above, you mention that “All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A). However in the “Action” column, they are all listed as a “Hold”. Would you recommend putting new money to work in the current lofty market?

Thanks for this fantastic website and all your valuable insight!

Cole

Cole,

If you currently own any of the listed ETFs, they are considered to be in “Hold” mode as opposed to “Sell” mode, which occurs once they drop off their highs by 7.5%. The “Action” column will reflect such a change.

For new money, I recommend the use of my incremental buying procedure as describe in the following video:

https://www.youtube.com/watch?v=9bMzdkYY-hk

Ulli…