1. Moving the Markets

The markets closed higher, driven higher by a bit calmer geopolitical tensions abroad, as well as favorable comments from the Fed. The S&P 500 gained 0.3%, the Dow rose 0.10% and the Nasdaq ended the day up 0.7%. Consumer staples and technology were the leaders in the S&P 500, and another interesting bit of news that circled today was that small cap companies have outperformed large cap companies in five of the past six trading sessions.

In the international realm, Russia announced today that it would send a humanitarian convoy into Eastern Ukraine, which could put a temporary stop to gunfights between the Ukrainian forces and rebels in the region. This perhaps eased concerns, at least for today.

Also, investors snapped up shares of companies developing potential treatments for the often fatal Ebola virus disease amid growing calls to expedite research funding and drug approvals. Amongst top performing pharmaceuticals today were Tekmira Pharmaceuticals Corp (TKMR) and U.S. based Sarepta Therapeutics Inc (SRPT).

Of our 10 ETFs in the Spotlight, 9 headed higher and 1 retreated slightly.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

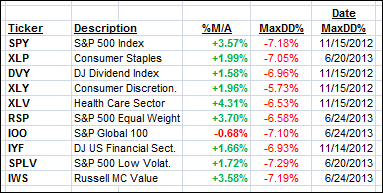

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

9 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

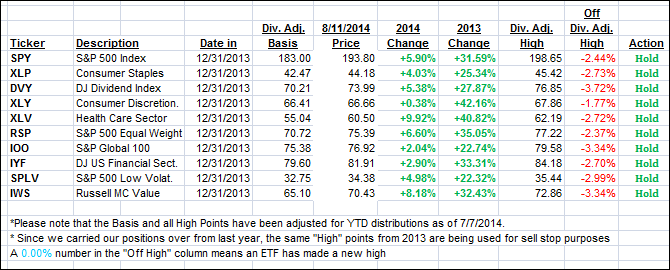

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) joined the upward momentum and closed as follows:

Domestic TTI: +1.82% (last close +1.57%)

International TTI: +0.75% (last close +0.17%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli