ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, August 15, 2014

EQUITIES MOVE HIGHER FOR SECOND CONSECUTIVE WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

The U.S. equity markets continued to recover from last week’s lows, moving higher for the second consecutive week. Solid corporate earnings results along with favorable M&A news provided a lift to the market, but international concerns such geopolitical developments and slow global economic growth weighed on the market with weak economic reports from Germany, France, and Japan.

For the week, the Dow rose 109 points to end the week at 16,663, up 0.7%. The S&P 500 increased 23 points, or 1.2%, to end at 1,955, and the Nasdaq gained to end the week up at 4,465. Markets are down only 2% from record highs in July.

In earnings news, network giant Cisco (CSCO) reported quarterly earnings of 55 cents per share, which topped street estimates of 53 cents per share. Despite the beat, the rest of the quarterly results disappointed as the company missed sales estimates and announced an additional round of job cuts. Shares of CSCO fell as much as 3% on the news.

3 of our below listed 10 ETFs in the Spotlight managed to gain during today’s wild ride while 7 of them pulled back slightly.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

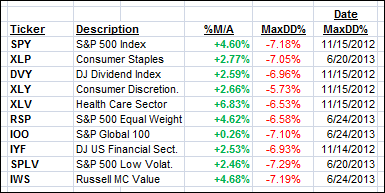

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

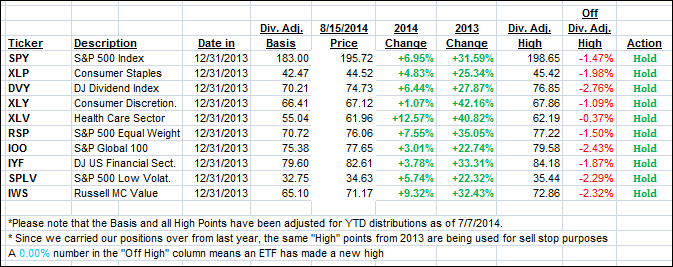

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recuperated and headed higher thanks to an assist by renewed upside momentum. Here’s how we closed out the week:

Domestic TTI: +2.29% (last Friday +1.57%)

International TTI: +1.30% (last Friday +0.17%)

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Jim:

Q: Ulli: Two points. The first is that corporate earnings are growing primarily because many companies are borrowing money at low interest rates to buy back stock. So, the earnings growth is not necessarily actual growth in their businesses.

The second is that foreign money is coming here because it is seen as stable compared to the rest of the world. Lots of Chinese, Arab, Russian, and European money. Ask realtors about foreign buyers. They are seeing a big upswing in foreign real estate purchases. People outside the U.S. are nervous about the state of affairs in the world. They see the U.S. with rose-colored glasses, IMO.

A: Jim: No argument there. That’s why it’s important not to focus on the superficial news events but only on the long-term trends in the market place, as they are the only true directional measure one can use to make investment decisions.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli