1. Moving the Markets

Stocks recovered a bit from some of the losses that were suffered last week. Investors were encouraged by positive corporate earnings announcements, including Berkshire Hathaway (BERK). The S&P 500 posted a 0.72% gain, the Dow rose 0.46% and the Nasdaq also added a 0.72% gain on the day.

In tech news, Apple (AAPL) launched its 13-inch and 15-inch retina display MacBook Pros with faster versions of Intel processors and tons of RAM. Also, reports are saying that Apple will be buying Concept.io, an app that delivers an audio news feed based on stories that it picks up from NPR, TED Talks and the Harvard Business Review. The stock is up 21.65% year-to-date.

Last week, the Dow dropped 2.8%, its biggest weekly drop in six months. The S&P 500 fell 2.7%, its largest percentage drop in over two years. Investors had several reasons to pull back: Argentina’s default, escalating violence in Ukraine, Israel and Gaza, as well as concerns that the Federal Reserve was poised to start raising interest rates next year. Let’s see what new news comes in this week that may shake, rattle and roll the markets.

Our 10 ETFs in the Spotlight joined the turnaround session with 9 of them gaining but no new highs were made.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

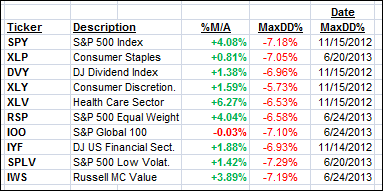

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

9 of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

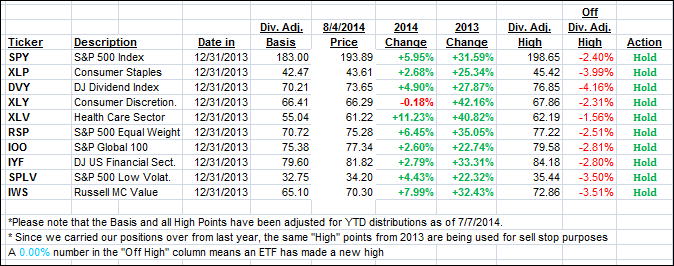

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) bounced back with the major indexes and closed as follows:

Domestic TTI: +1.61% (last close +1.23%)

International TTI: +1.39% (last close +1.07%)

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli