1. Moving The Markets

Stocks continued to climb on Wednesday, driven by news that businesses added 281,000 jobs last month, up from 179,000 in the previous month. The figure suggests the government’s monthly jobs report, due out Thursday, could also show a significant gain from May. Two of the three major indexes gained slightly as the chart above shows.

Airline stocks took a dip today after Delta (DAL) said revenue per passenger fell on international routes due to decreased travel to Latin America during the World Cup. Delta’s stock fell 5.1%. American Airlines Group (AAL) and United Continental (UAL) were also down sharply.

You may remember me mentioning the GoPro (GPRO) IPO last week. Well, the stock seems to have calmed down as shares of the wearable video camera company were down for the first time since its IPO last Thursday, albeit shares are still trading above $42 — a significant premium above the IPO price of $24.

While world cup fans are consumed with the excitement of the tournament, they might not be aware that Argentina’s stock market is the world’s best performing stock market so far in 2014. The benchmark Mercado de Valores de Buenos Aires (Merval) has gained 47% since January, making it the top performer in a group of 40 global stock markets researched by Bespoke Investment Group.

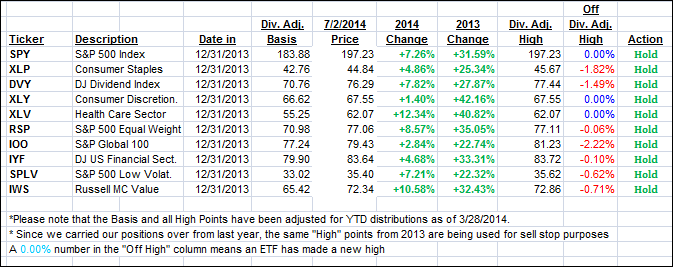

Four of our ten ETFs in the Spotlight made new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

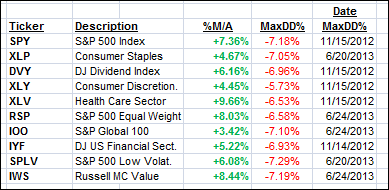

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) ended the day mixed with the Domestic one retreating slightly and the International one gaining a tad:

Domestic TTI: +3.93% (last close +4.01%)

International TTI: +4.88% (last close +4.78%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli