1. Moving The Markets

Stocks were back on track today, with the S&P breaking back through record territory and the Dow approaching historical highs. The Dow is now within a scant 17 points of its all-time closing high of 16,715.44.

It was all about recent economic updates we received today. The latest economic data that came in showed a drop in jobless claims to a rate near that of 2007. However, we also received the revised GDP numbers today that showed the economy contracted in Q1 by a bit more than was originally reported. This was no surprise though given the harsh winter that slowed business down across the east coast.

Corporate deals, from pharma to sausages, still remain at the forefront of market news and we were hit with another one today. We received news that Apple (AAPL) intends to buy the mainstream headphone giant Beats Headphones for $3 bil. Apple has never been a contender when it comes to the headphone market, so the bid for Beats could provide new avenues for revenue as the company succumbs to more and more competition in the computer/tablet/phone world. Apple’s stock was up 1.82% on the day.

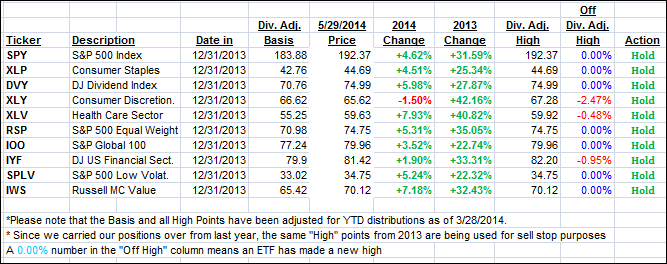

Our 10 ETFs in the Spotlight rallied with 7 of them making new highs; 9 of them remain on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

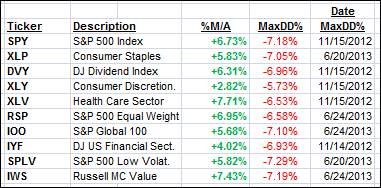

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) joined the rally and closed higher for the day:

Domestic TTI: +3.44% (last close +3.22%)

International TTI: +4.53% (last close +4.32%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli