1. Moving The Markets

Stocks dwindled around breakeven for most of the day, but finished strong led by Internet stocks and mixed M&A success. All the major indexes closed higher as the chart above shows.

In M&A news, AstraZeneca (AZN) rejected yet another takeover bid from Pfizer (PFE). AstraZeneca rejected a revised £69 billion ($116 billion) bid from Pfizer, saying the U.S. company’s “final” offer is inadequate and would present significant risks for shareholders. The most recent offer would give AstraZeneca shareholders 26% of the merged company, indicating that there is a small window for a higher cash component. Pfizer has said though that the £55 per share bid is “final” and that it would not go hostile.

Shares of AT&T (T) also slumped today after the company’s $48.5 billion bid for satellite TV operator DirecTV (DTV) was rejected.

First quarter earnings season continues to wind down in the U.S. More than 90% of companies have posted results and profit gains among S&P 500 stocks are up just more than 2% from a year earlier, according to FactSet. Campbell Soup (CPB) experienced a 2.4% drop today after reporting weaker-than-expected quarterly sales and lowered its full-year revenue growth forecast. Home Depot (HD), TJX (TJX), Lowe’s (LOW), Target (TGT) and Hewlett-Packard (HPQ) are among notable companies slated to post results throughout the week.

Our 10 ETFs in the Spotlight edged higher although no new highs were made today; 9 of them currently remain on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

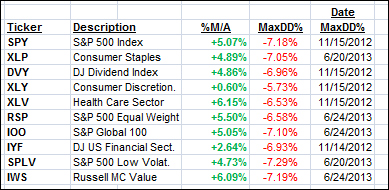

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

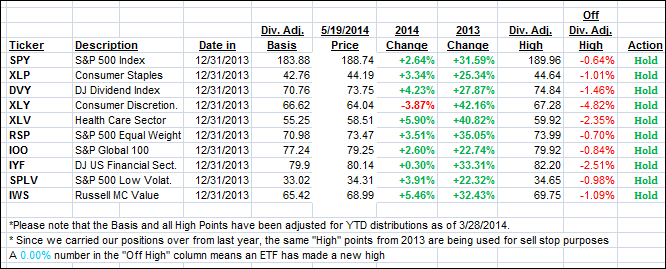

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed north and setttled deeper on the bullish side of their respective trend lines:

Domestic TTI: +2.39% (last close +2.05%)

International TTI: +3.18% (last close +2.87%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli