ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, January 3, 2014

A CHOPPY WEEK ON WALL STREET

[Chart courtesy of MarketWatch.com]1. Moving The Markets

Overall, volumes on Wall Street were thin this week, with many traders still on vacation. Also, a major storm in the Northeast hampered travel and states of emergency were declared in New York and New Jersey.

U.S. stocks ended a choppy trading session mostly lower on Friday after Federal Reserve Chairman Ben Bernanke defended the extraordinary measures undertaken by the central bank to boost the economic recovery. The S&P 500 (SPX) slipped less than a point leaving it down 0.6% for the week. The Dow Jones Industrial Average (DJIA) closed up 0.2% but finished the week marginally lower and the tech-heavy Nasdaq Composite (COMP) shed 0.3% on Friday and lost 0.8% for the week.

In the ETF world, WisdomTree, an exchange-traded fund sponsor and asset manager, has announced the launch of the WisdomTree Bloomberg US Dollar Bullish ETF (USDU). The fund, which is linked to the Bloomberg Dollar Total Return Index, seeks to provide exposure to the US dollar against a broad basket of developed and emerging market currencies based on global trade flows and liquidity measures. The nascent actively managed ETF space is just beginning to expand, and you should expect more options as money managers try to edge into mutual fund territory with a cheaper investment wrapper.

As we continue on into 2014, you will most likely see more actively managed ETFs that cover target income, commodities, emerging markets, managed futures, hedged products and other alternatives.

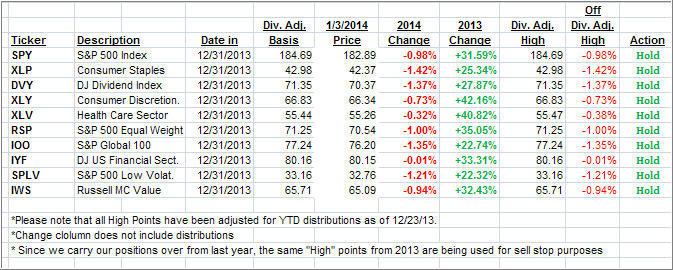

Our 10 ETFs in the Spotlight came off their highs to varying degrees but all remain on the bullish side of their respective trend lines.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Now let’s look at the MaxDD% column and review the ETF with the lowest drawdown as an example. As you can see, that would be XLY with the lowest MaxDD% number of -5.73%, which occurred on 11/15/2012.

The recent sell off in the month of June did not affect XLY at all as its “worst” MaxDD% of -5.73% still stands since the November 2012 sell off.

A quick glance at the last column showing the date of occurrences confirms that five of these ETFs had their worst drawdown in November 2012, while the other five were affected by the June 2013 swoon, however, none of them dipped below their -7.5% sell stop.

Year to date, here’s how the above candidates have fared so far:

3. Domestic Trend Tracking Indexes (TTIs)

Looking at the big picture, our Trend Tracking Indexes (TTIs) slipped from last week’s high but remain above their long term trend lines by the following percentages:

Domestic TTI: +4.09% (last Friday +4.58%)

International TTI: +6.20% (last Friday +7.05%)

Have a great week.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Don:

Q: Ulli: I have been using a 7% sell stop which you have recommended, or used, in the past. Lately I have noticed you talk about a 7.5% sell stop. Have you changed your sell stop to 7.5%?

A: Don: The 7% level has been my alert point, but I always have executed once the 7.5% level was crossed.

To avoid confusion, I have used the 7.5% level in my back tests as described in the e-book. Please realize that this is not an exact science and some investors sell even before the 7% level is reached while others use 8%. It all depends on their risk tolerance. The main idea is to have some kind of an exit strategy to avoid participating in the major market downturns.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli