1. Moving The Markets

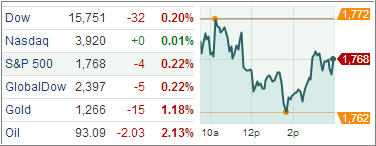

The major indexes meandered with the Dow coming off its record high as worries about the Fed reducing its stimulus program sooner rather than later. Atlanta Fed president Lockhart threw the fly in the ointment by proclaiming that the central could cut back its bond buying program as soon as December while Dallas Fed president Fisher chimed in that they will have to taper at some point.

And that’s how it will be from heron forward, as markets may rally on mediocre economic news and sell off on positive ones; we’ve seen that theme all year. Again, personally, I don’t believe that the economy has any staying power on its own, and we may very well see increased stimulus next year rather than a reduction.

The S&P’s two-day winning streak came to an end as the earnings season is winding down. Today’s predominantly sideways action may continue for a while until a new driver emerges that could propel the indexes higher; of course, the fear of a long overdue correction will always be with us, so be prepared to have your exit strategy in place via my recommended trailing sell stop discipline.

Here are our ETFs in the spotlight:

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, all of them never triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Now let’s look at the MaxDD% column and review the ETF with the lowest drawdown as an example. As you can see, that would be XLY with the lowest MaxDD% number of -5.73%, which occurred on 11/15/2012.

The recent sell off in the month of June did not affect XLY at all as its “worst” MaxDD% of -5.73% still stands since the November 2012 sell off.

A quick glance at the last column showing the date of occurrences confirms that five of these ETFs had their worst drawdown in November 2012, while the other five were affected by the June 2013 swoon, however, none of them dipped below their -7.5% sell stop.

Year to date, here’s how the above candidates have fared so far:

3. Domestic Trend Tracking Indexes (TTIs)

Trend wise, our Trend Tracking Indexes (TTIs) retreated slightly but remain above their long term trend lines by the following percentages:

Domestic TTI: +3.86% (yesterday +4.00%)

International TTI: +6.57% (yesterday +6.73%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 2

Ulli – I’m wondering why the international TTI is still 6.57% above its trend line when VWO is well below its 200 day SMA and in a significant downward spiral. Please see the chart at this link: http://stockcharts.com/h-sc/ui?s=VWO&p=D&yr=0&mn=6&dy=0&id=p74340931489

Thanks for your clarification on this.

Ian

Ian,

The International TTI is a representation of “broadly diversified international funds/ETFs.” This does not include volatile country or emerging market funds. For those, you would use their own respective M/As to make your buy/sell decisions. That’s why they are listed in separate sections of the weekly StatSheet.

Ulli…