1. Moving The Markets

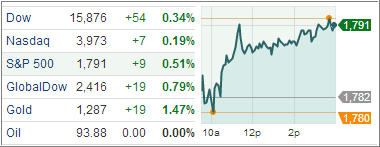

Major U.S. market indexes moved higher as Janet Yellen, likely to win confirmation for the top post at the Federal Reserve, said the economy continues to need monetary support, bolstering expectations for prolonged stimulus measures. The S&P 500 rose 0.5% to 1,790.62 while the Dow Jones Industrial Average gained 0.4% to 15,876.22.

Weekly initial jobless claims fell by 2,000 to 339,000 in the week ended Nov. 9, the Labor Department reported Thursday, but still came in higher than the 330,000 expected by economists. Global markets were gaining ground while Treasury yields eased, driven by confidence of continued Fed support.

In ETF news, UBS Investment Bank has launched the ETRACS Monthly Pay 2x Leveraged Diversified High Income ETN (DVHL) on the NYSE. This should be exciting for those looking for income on a diversified asset pool, although some historical data will have to be established first before this newcomer can be considered as a valid alternative.

Let’s head over to our ETFs in the spotlight:

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, all of them never triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Now let’s look at the MaxDD% column and review the ETF with the lowest drawdown as an example. As you can see, that would be XLY with the lowest MaxDD% number of -5.73%, which occurred on 11/15/2012.

The recent sell off in the month of June did not affect XLY at all as its “worst” MaxDD% of -5.73% still stands since the November 2012 sell off.

A quick glance at the last column showing the date of occurrences confirms that five of these ETFs had their worst drawdown in November 2012, while the other five were affected by the June 2013 swoon, however, none of them dipped below their -7.5% sell stop.

Year to date, here’s how the above candidates have fared so far:

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) followed the markets higher and remain above their long term trend lines by the following percentages:

Domestic TTI: +4.69% (yesterday +4.43%)

International TTI: +7.35% (yesterday +6.97%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli