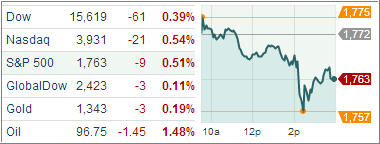

U.S. equity markets were unable to extend recent gains as stocks closed the trading session lower on the heels of yesterday’s record setting performances for the Dow and S&P. In economic news, the Federal Reserve announced no changes to its asset purchase program, leaving the target for the fed funds rate unchanged near zero.

Trading was volatile following the release of the statement, with the major U.S. stock indexes cutting losses to turn flat and dropping to session lows. Moreover, the ADP employment change report showed that private sector payrolls rose at a lower-than-forecasted rate, while separate reports showed consumer prices remained benign and weekly mortgage applications rose. Treasuries were mostly lower following the Fed statement and domestic data.

Although stocks slumped in reaction to the release, I want to point out that today’s weakness occurred after the S&P rallied more than 7.0% over the course of 15 sessions since October 8. Therefore, it is more likely the policy statement served as an excuse for the selling rather than a catalyst.

All ten sectors settled in the red, but their losses were limited to less than 0.8%. Defensive sectors led to the downside, and consumer staples (-0.8%) ended at the bottom of the leaderboard. Meanwhile, utilities (-0.7%) ended among the laggards despite seeing some intraday strength in reaction to above-consensus earnings from Exelon.

In earnings news, General Motors posted stronger-than-expected profits despite smaller-than-forecasted revenues, while Comcast posted disappointing 3Q revenues. Elsewhere, gold was slightly lower, crude oil prices were mixed, while the U.S. dollar was higher.

The European equity markets erased early gains and finished mostly lower with traders digesting the disappointing employment data in the U.S. ahead of today’s Federal Reserve’s monetary policy announcement.

Meanwhile, Spain’s 3Q GDP grew 0.1% quarter-over-quarter, matching expectations, after contracting 0.1% in 2Q, while Germany’s unemployment unexpectedly rose in October.

Separately, eurozone economic confidence improved more than expected for this month. Elsewhere, stocks in Asia finished higher on the heels of another record high for the S&P 500 Index in the U.S. yesterday, ahead of today’s monetary policy decision by the Fed.

It’s nor surprise that our Trend Tracking Indexes (TTIs) pulled back with the Domestic TTI ending the day at +4.88% while the International TTI settled at +8.42%.

Contact Ulli