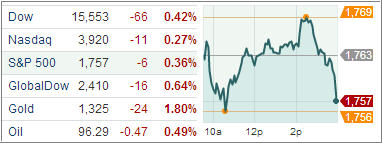

Domestic Equity Index ETFs finished a choppy trading session below the flat-line, as investors mulled a mixed bag of earnings and economic data along with yesterday’s decision by the Federal Reserve to maintain its current pace of asset purchases.

While it was a second consecutive day of losses for the market, all three major indexes ended October with solid gains. Elsewhere, Treasuries were mixed following yesterday’s Fed decision and as a slightly higher-than-expected rate of weekly U.S. initial jobless claims was met with an unexpected jump in Midwest manufacturing activity. Finally, gold and crude oil prices dipped, while the U.S. dollar appreciated.

Stock indices spent most of the session near their respective flat lines. Trading volume was subdued until the last 30 minutes of action when a surge in trading activity sent equities to lows while pushing the final volume tally up. In earnings news, Dow member Visa posted inline quarterly results but offered some cautious commentary, and Starbucks beat the Street’s profit expectations, while issuing disappointing guidance. Moreover, Dow component Exxon Mobil Corp bested the Street’s estimates.

The benchmark index displayed early weakness as the broader market followed in the footsteps of the financial sector (-1.1%). Financials finished at the bottom of the leaderboard while also ending the month behind the remaining nine sectors with an October gain of 3.2%. Only the consumer discretionary space (XLY) posted a gain (+0.2%) with media names providing support after Time Warner Cable reported better-than-expected results.

In overseas news of note, eurozone unemployment (12.2% actual versus 12.0% expected) and CPI (0.7% actual versus 1.1% consensus) came in well-below estimates, which stoked expectations for additional liquidity provisions from the European Central Bank.

Investors received just two economic data points today: Jobless claims slightly above estimates, while regional manufacturing activity jumped. Weekly initial jobless claims declined to 340,000 last week, just above the 338,000 level that economists had expected.

Our Trend Tracking Indexes (TTIs) pulled back as well but remain solidly above their respective long-term trend lines by +4.69% (Domestic TTI) and +8.04% (International TTI).

Contact Ulli