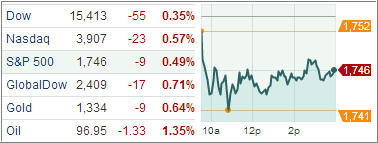

Following four-straight sessions of record highs for the S&P 500, domestic equities finished the session in negative territory on Wednesday as shares of heavy-equipment maker Caterpillar and semiconductor companies tumbled after they reported earnings.

Moreover, Chinese liquidity and banking concerns along with uncertain domestic earnings reports weighed on sentiment. Meanwhile, Treasuries were mixed following reports that showed U.S. import prices rose and mortgage applications dipped. Finally, gold and crude oil prices dipped, while the U.S. dollar was nearly unchanged.

Reports out of the Middle Kingdom suggested the largest Chinese banks saw their debt write-offs triple during the first half of the year. Separate headlines indicated the People’s Bank of China may tighten monetary policy due to excessive inflation. The liquidity crunch has made its presence known through the overnight Shanghai Interbank Offered Rate, which jumped 73 basis points to 3.78%. In addition to the news from China, stocks had to endure continued weakness among momentum names.

On corporate earnings front, Dow member Boeing easily exceeded the Street’s quarterly expectations and increased its full-year profit outlook, while fellow Dow component Caterpillar severely missed analysts’ quarterly forecasts and cut its full-year guidance.

Elsewhere, stronger-than-forecasted earnings reports from Eli Lilly, Bristol-Myers Squibb, and Amgen were met with some uncertainty regarding their pipelines of new drugs, while Broadcom Corp issued disappointing 4Q revenue guidance. Chipmakers were victimized by heavy selling as the PHLX Semiconductor Index tumbled 3.4%.

Even though select tech names displayed significant losses, the broader sector ended in-line with the S&P. Meanwhile, most other cyclical groups underperformed and the industrial sector was the only cyclical group that ended ahead of the broader market.

Industrials outperformed, building on the relative strength of better-than-expected earnings. However, the sector could not turn positive due to the underperformance of Caterpillar, which lost 6.1% after missing on earnings, revenue, and issuing cautious guidance. Although equity indices spent the entire session in negative territory, only the energy sector (-1.4%) posted a loss exceeding 1.0% as crude oil slid 1.4% to $96.95 per barrel. Countercyclical sectors outperformed with consumer staples ending in the lead with a modest gain of 0.1%.

Our Trend Tracking Indexes (TTIs) pulled back and ended this day at +4.84% (Domestic TTI) and +8.62% (International TTI).

Contact Ulli