The ETF/No Load Fund Tracker

Monthly Review—September 30, 2013

US Stocks Finish Higher For Third Straight Quarter

Major US equity indexes advanced in September, posting their third straight quarter of gains even as the markets turned choppy toward the end amid concerns over the ongoing budget debate and in anticipation of a government shutdown.

The blue-chip Dow Jones Industrial Average (DJIA) ended at 15,129.67, up 2.2 percent for the month and 1.5 percent for the quarter.

The benchmark S&P 500 index finished at 1681.55, picking up 3 percent for September. The index added 4.7 percent for the quarter and had hit a record high on Sept 18 after the Federal Reserve unexpectedly refrained from cutting its $85 billion in monthly bond purchases.

The budget battle in Washington continued to weigh on the markets while economic data conveyed the familiar message of modest to moderate growth and low inflation. The US Labor Department announced on Sep 30 it would not release the all-important nonfarm payroll report this week, should the government shut down in Washington though many analysts thought the September report would be a non-event anyways due to the ongoing budget battle and the looming partisan dispute over the nation’s debt ceiling.

Nevertheless, Economists view the payroll report as an important metric as the Federal Reserve ties its policy decisions to the strength of the labor market. The FOMC committee is likely to hold its monetary policy steady when they meet this month in anticipation of elevated volatility.

Stock and bond markets got a boost after Larry Summers, perceived to be the hawkish frontrunner, withdrew his name from consideration to be the next Fed chief.

Also, news of Russia and the US agreeing to decommission Syria’s chemical weapons within a year contributed to the market’s rise.

Consumer spending rose for a fourth month in August, rising 0.3 percent versus an upwardly revised 0.2 percent in the prior month.

On the flip side, the University of Michigan/ Thomson Reuters final September iteration on consumer sentiment dropped to 77.5 from 82.1 in August.

August retail sales growth came in lower than anticipated at 0.2 percent while the total producer price index rose to 0.3 percent. Core PPI, which excludes volatile components like energy and food, remained unchanged.

Separately, data released by Automatic Data Processing Inc showed private-sector employers added 166,000 jobs in September, falling short of the 180,000 gain economists had forecast.

Also, data showed the US economy expanded at an unrevised 2.5 percent in the second quarter, off the 2.7 percent rise economists had projected.

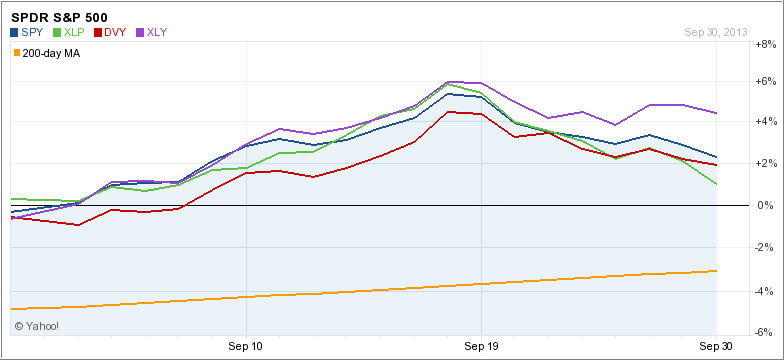

In regards to short-term trends, the pullback from August came to a halt and prices of our main holdings headed back up. Here’s the 30-day chart showing the recovery in price, although towards the end of September we dipped down slightly as angst over the debt ceiling and government shutdown took center stage.

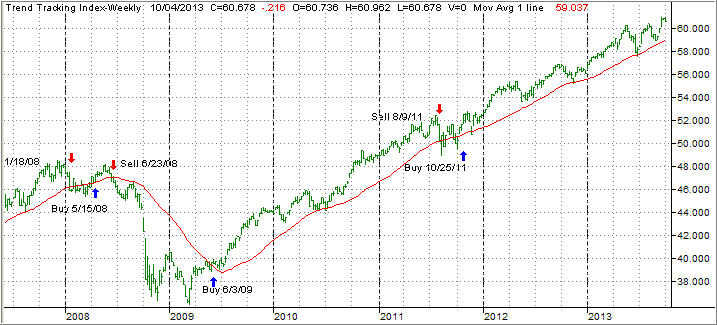

Longer term, the trend has remained bullish despite the bobbing and weaving we have seen. Our main indicator, the Domestic Trend Tracking Index (TTI) remains on the bullish side of the trend line as the chart shows:

Most of our holdings have come off their highs but have not triggered their respective trailing sell stops. The weakest link in the chain over past quarter has been the star performer of the 1st half of 2013, namely consumer staples (XLP).

It has displayed some sensitivity to the occurrence of higher interest rates, which could change quickly if rates head back down due to slower than expected economic growth. XLP is also closest to triggering its sell stop should more market weakness develop.

With the uncertainty of the negotiations in Washington being far from over, I will monitor our sell stops closely and execute them when necessary. History shows that past budget negotiations have ended with a last minute compromise, with the exception of 2011, causing the market to re-establish its main upward trend. Nevertheless, an exit strategy is absolutely necessary should Washington’s hot heads prevail.

Contact Ulli