U.S. equities were broadly lower, as lawmakers on Capitol Hill continued to quarrel about spending issues with today’s midnight deadline to avoid a partial government shutdown, which is now quickly approaching.

Moreover, Italian political turmoil and a disappointing manufacturing activity read from China exacerbated sentiment. Meanwhile, Treasuries were higher following stronger-than-expected reads on domestic regional manufacturing activity and, as the fiscal showdown in Washington heats up, may be reflecting increased demand for safe haven assets.

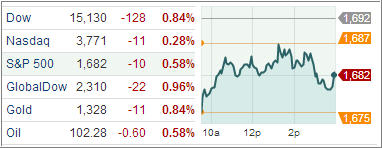

Stocks stumbled out of the gate. All ten sectors settled in the red with consumer staples (-1.1%) leading to the downside. Meanwhile, other countercyclical groups ended mixed. Health care (-0.3%) and utilities (-0.1%) outperformed while telecom services (-0.6%) finished in-line. The S&P 500 struggled with its 50-day moving average (1,680) throughout the afternoon, but managed to close just above that level despite weakness among several cyclical sectors.

Elsewhere, major financials lagged throughout the day. JPMorgan Chase was the weakest performer among the majors while the broader sector lost 0.7%. Lastly, the technology sector saw some of its top components like Apple, Oracle, and Visa lose between 1.0% and 1.8%.

The only positive result is that major indexes ended September with solid monthly gains after August’s losses. For the month, the Dow rose 2.2 percent, S&P 500 index ended up 3 percent and the Nasdaq added 5.1 percent.

A government shutdown would have wide-ranging implications for most assets. If a deal were reached quickly, markets might recover, but a prolonged shutdown could harm the economy and consumer confidence.

Historically, Wall Street has managed to avoid the steep downside during similar incidents. During the federal government shutdown from December 15, 1995, to January 6, 1996, the S&P 500 added 0.1 percent while during the November 13 to November 19, 1995 shutdown, the benchmark index rose 1.3 percent, according to SentimenTrader.com. While a deal could still be reached before the government’s fiscal year ends at midnight on Monday, such a possibility seems now unlikely.

Our Trend Tracking Indexes (TTIs) pulled back as well with the Domestic TTI ending at +3.05% while the International TTI closed at +6.45%.

Contact Ulli

Comments 1

The tea leaves are pretty wrinkled now, thus hard to read. But the stock market has to be driven by the top 1% of rich people and the Republicans who work for the top 1% (as Romney told us) shut down the government which has to slow down the economy. But the market went up quite strongly today. So my reading suggests that this battle will not last very long. I also believe Pres. Obama will cave only over his dead body. He has no more elections to fight. Please give me a better explanation.