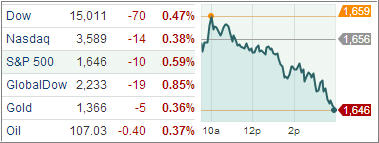

The above picture is worth a thousand words. U.S. equity markets closed in negative territory for the fourth-straight session to start the week off on a sour note, after energy shares dropped and Treasury yields again jumped to a two-year high.

Today marked the first occurrence of a 4-day losing streak for both the S&P 500 Index and Dow this year. The Nasdaq was positive for most of the session, spurred by gains in technology shares, such as Apple and Google, before selling pressure in the last hour of trading turned the index negative. Investors are eagerly awaiting the mid-week release of the minutes from the most recent Federal Open Market Committee meeting.

While today’s economic calendar did not provide anything for traders to mull, the rest of the week will offer some insight into the health of the economy, headlined by the minutes from the Fed, likely keeping the timing and pace of Fed tapering and the prospect for rising interest rates in the bond market on center stage.

Some analysts believe the economy appears on the rebound, but neither hot enough to force the Fed’s hand nor cold enough to engender recession fears. However, given elevated market sentiment, seasonal tendencies and some technical deterioration within the stock market, many believe the market has become vulnerable to a pullback.

The major averages were mixed and little changed for much of the session, but they broke down in late trading. There was not a specific news catalyst for the late-day breakdown, which led some to conclude it was a function of technical factors at work where buyers did not want much to do with the market.

Treasuries were lower, with 10-year and 30-year yields touching fresh two-year highs, which means bond ETFs have not been providing any portfolio stability during this market pullback. The rate-sensitive financial sector (-1.3%) was a notable laggard all day and a major drag on the broader market along with the energy sector (-1.5%).

The latter got clipped by yet another day of losses for ExxonMobil, which declined for the 18th time in the last 20 sessions. The financial sector was hurt by a report JPMorgan Chase is being investigated for its hiring practices in China and a Wall Street Journal article suggesting the sector could fall out of favor in the wake of a tapering decision.

Other rate-sensitive areas like the high dividend-yielding utilities (-0.8%) and telecom services (-0.8%) sectors also underperformed the market. The home building stocks were among the weakest performers today with losses ranging between 3-5%.

With so much weakness, it’s no surprise that our Trend Tracking Indexes (TTIs) headed a little closer to their respective trend lines with the Domestic TTI closing at +1.39% while the International TTI ended the day at +5.18%.

Contact Ulli