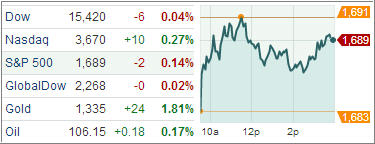

The major market ETFs began the trading week in limbo, giving the Standard & Poor’s 500 Index its fifth drop in six sessions, as an empty economic calendar and news on the equity front failed to inspire investors.

A weak read on 2Q GDP out of Japan became a little dark cloud early on, as markets across the Atlantic were also unable to find direction, while equity and economic news from abroad was also in short supply. Trading volume was light, marking one of the five days this year with fewer than 5 billion shares traded over a full session. Earnings period is drawing to a close as the market enters the seasonally slow period.

Today’s economic data was limited to wholesale inventories which fell 0.2% in June, contrary to expectations for a 0.5% gain. The decline was the third in row, resulting in 1.7% annualized drop in Q2. This suggests the inventory investment contribution to GDP would likely be revised lower, as wholesale inventories account for about 1/3 of total inventories.

Meanwhile, the July Treasury budget showed a deficit of $97.6 billion following a deficit of $69.6 billion in July 2012. Overseas, a report showed that Japan’s 2Q GDP expanded at an annualized rate of 2.6%, well below the 3.6% rate of expansion that economists had forecasted.

Stocks began in the red after Japan’s GDP report. Gold futures advanced 1.8% while silver futures surged 4.6%. In turn, miners rallied broadly, spiked 5.8%. However, the outperformance of miners was not enough to keep the materials sector (-0.2%) out of the red. Similarly, most other growth-oriented sectors registered losses.

Elsewhere, the tech sector ended in the lead, contributing to the outperformance of the Nasdaq. The top-weighted sector component, Apple, settled higher by 2.8% following an International Trade Commission decision to issue an import sales ban on some Samsung devices after the company infringed on Apple patents. Remaining in the tech sector, BlackBerry was another notable outperformer after the company said it has begun exploring strategic alternatives. The solid gains in technology helped the S&P climb off its early lows, but the index was unable to close in the green. However, small caps outperformed as the Russell 2000 advanced 0.5%.

Today was a quiet start to a busy economic week. The domestic docket will shift gears and get moving tomorrow, with key reports in the form of advance retail sales and the Import Price Index.

Our Trend Tracking Indexes (TTIs) slipped from Friday’s close to end the day at +3.26% and +6.66% for the Domestic and International TTI respectively.

Contact Ulli